How to Automate the Loan Origination Process with Smart Structuring

Automated finance structuring refers to the design of a loan or lease, including how the terms, rates, and payment schedules are arranged to meet the needs of both the lender and the borrower.

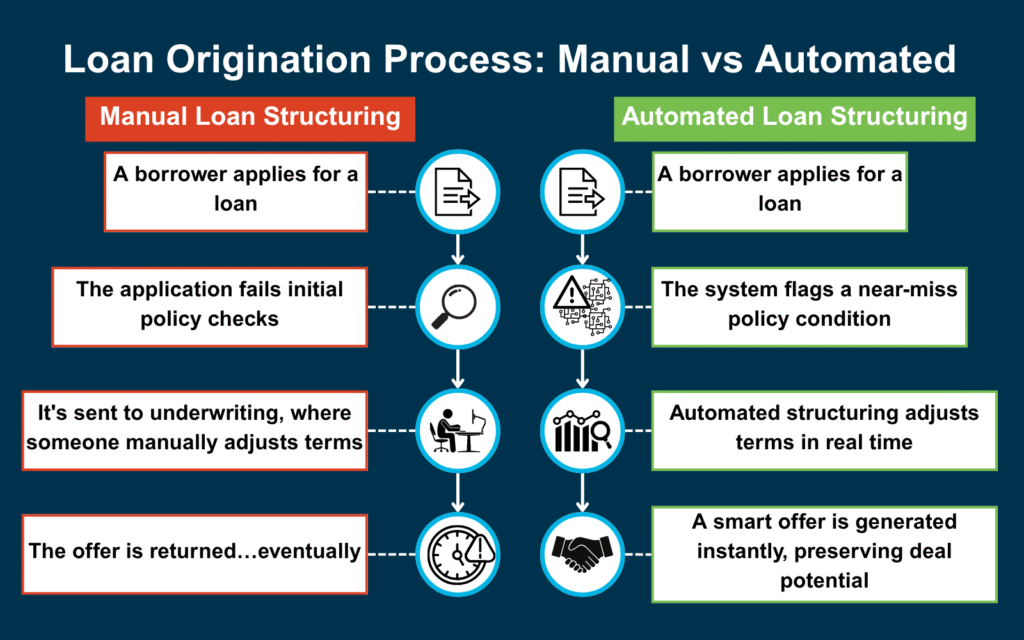

For lenders, good structuring balances risk and profitability. For borrowers, it makes the asset more affordable and accessible. In the past, underwriters made these decisions manually. Today, top-performing lenders use automated tools embedded in their loan origination system (LOS) to structure deals in real time.

The comparison below illustrates the difference between traditional manual structuring and a modern, automated approach:

If your LOS can’t restructure deals automatically based on risk thresholds, residual values, or regional policy overlays, you’re bleeding approvals. This article covers how to automate the loan origination process with smart structuring, its benefits, and core features to look for in a modern LOS with structuring capabilities.

How to Automate the Loan Origination Process with Smart Structuring

Implementing automated structuring to your loan origination process doesn’t require overhauling your entire tech stack. It starts with aligning your credit policy to automation logic. Here’s a step-by-step approach on how to automate the loan origination process with structuring:

Step 1: Audit Your Current LOS and Underwriting Logic

Evaluate how your current loan origination system handles near-miss applications. Are approvals delayed by manual reviews? Is every exception routed to underwriting? Identify where automation can streamline decisioning.

Step 2: Define Thresholds and Map to Structuring Rules

Establish clear parameters, such as max DTI (debt-to-income ratio), minimum down payment, or term caps, and create if-then logic for adjustments. For example: if DTI > 40%, extend term or require co-signer.

Step 3: Use a Platform Like defi ORIGINATIONS to Configure and Deploy

Modern LOS platforms like those offered by defi SOLUTIONS let you implement structuring rules without custom code. Business users can configure, test, and deploy logic in a no-code environment.

Step 4: Monitor Metrics and Optimize

Track approval rates, pull-through ratios, and capture rates by channel or program. Use A/B testing to improve structuring logic over time and ensure automation is delivering better decisions.

Two Common Structuring Workflows

To see how this plays out in real-world lending, here are two common scenarios where automated structuring helps preserve deal potential

Scenario 1: Minor Miss, Smart Adjustment

The application just barely misses standard approval criteria: for example, the DTI ratio is slightly too high, or the down payment is lower than preferred. Instead of rejecting the application outright, the system dynamically adjusts the offer terms to preserve deal potential:

- Term: Extended from 60 to 72 months

- Rate: Slightly reduced from 9.5% to 8.9% to increase affordability

- Down Payment: Nudged from $1,000 to $1,500 to meet minimum thresholds

The borrower instantly receives a compliant, customized offer that improves approval odds without sacrificing transparency or fairness.

Scenario 2: Complex Fail, Tiered Recovery

The application falls outside multiple credit policy thresholds. Perhaps the credit score is low, the DTI is high, or the requested loan amount exceeds guidelines. Instead of issuing an outright denial, the system applies a tiered decision waterfall to salvage the deal:

- Amount Financed: Reduce the amount financed to limit risk exposure

- Loan Term: Shorten the loan term to improve payoff predictability

- Approval Conditions: Add approval conditions, such as verified income documentation or a qualified co-signer

The borrower receives one or more alternative offers that meet compliance standards while preserving customer engagement and dealer satisfaction.

Benefits of Automated Finance Structuring

Below are five strategic advantages of implementing automated structuring within your loan origination system:

1: Faster Approvals = More Captures

According to a Stratyfy survey, 85% of respondents stated the speed of loan approval is a top factor in choosing a lender.

Automated structuring reduces time-to-decisioning by eliminating manual back-and-forth on near-miss applications. Instead of sending all borderline apps to underwriters, the system evaluates policy thresholds, like DTI, LTV, or down payment, and instantly applies policy-aligned adjustments (e.g., longer term, lower amount financed). That means applicants get a qualified offer in seconds instead of hours.

2: Fewer Applications Sent to Underwriting

Manual underwriting teams are often overloaded with applications that just need minor adjustments. Structuring automation triages those files.

Applications that fail on one or two variables are automatically restructured within the risk policy and re-evaluated, without human involvement. This keeps underwriters focused on edge cases like thin files, manual verifications, or policy exceptions.

The result is faster pipeline movement, reduced labor costs, and higher underwriter productivity.

3: Greater Deal Flexibility

Instead of issuing a single “yes” or “no,” automated structuring returns multiple compliant deal variations: different terms, rates, or required down payments. This gives the dealer options to negotiate on the spot and empowers the borrower to choose what works best for their budget.

This flexibility helps build trust, increase transparency, and reduce decision friction. It also minimizes “ghosting” by borrowers who might otherwise walk away from a single rigid offer.

4: Higher Dealer Satisfaction

Dealers care about speed, consistency, and flexibility, especially when working with high-volume lenders. Structuring automation streamlines the approval process and delivers real-time feedback, helping F&I managers move faster and fund more reliably.

In fact, shortening F&I wait times by just 15 minutes can boost Net Promoter Score (NPS) by 19 points, a clear sign that faster decisions improve the overall dealer and customer experience.

5: Reduced Turn-Downs, Improved Pull-Through Rates

Traditional rules-based systems often reject applications outright if they miss a single criterion. With loan structuring automation, the system explores multiple ways to keep a deal alive. For example, if a borrower’s DTI is slightly high, the system might lower the amount financed, add a co-signer condition, or extend the term, all automatically.

This improves pull-through by giving applicants more chances to qualify while staying inside your risk tolerance.

Dynamic Rule Sets: Built for Change

Today’s best loan origination systems (LOS) are designed with agility in mind. Gone are the days when changing loan structuring rules meant submitting IT tickets or waiting weeks for deployment. With modern LOS platforms, you can adapt in near real time, and no dev team is required.

- Business users stay in control: Non-technical teams can easily update key variables like rate caps, debt-to-income (DTI) thresholds, loan-to-value (LTV) limits, term lengths, and down payment minimums, all through an intuitive admin interface. This gives credit risk managers and ops teams the power to respond immediately to market or portfolio changes.

- Speed to market: Rule changes can go live in hours instead of weeks, helping lenders adapt to regulatory updates, new promotions, or shifting risk appetites, without waiting on development backlogs.

- Performance-backed optimization: Built-in analytics dashboards show how each rule change impacts key metrics like approval rate, capture rate, and pull-through. You can track conversion performance by term, tier, product, or even FICO band.

- Pro tip: Leading lenders use A/B testing within their structuring logic, comparing the performance of different rate/term/down payment combinations, to boost their approval-to-book ratio without compromising risk standards.

Selecting the Best LOS

All loan structuring tools aren't created equal. Platforms that offer flexible configuration, real-time logic, and seamless delivery give lenders a clear edge. Below is a breakdown of the key features that define a best-in-class structuring solution, and why they matter:

|

Feature |

What It Does |

Why It Matters |

|---|---|---|

|

Real-time structuring |

Applies lender credit policies dynamically at the moment of application |

Accelerates decisioning, improves borrower experience, and boosts capture rates |

|

Configurable rules and waterfall logic |

Enables business users to define fallback paths for borderline applications |

Avoids hard declines, increases approvals, and reduces underwriting workload |

|

Multi-offer output (good/better/best) |

Generates multiple approval options per app |

Improves borrower choice and dealer negotiation flexibility |

|

Audit-ready decision rationale |

Automatically logs policy rules behind every structuring outcome |

Strengthens compliance, simplifies audits, and supports regulatory transparency |

|

Dealer portal integration |

Instantly delivers offers to dealers through existing digital workflows |

Speeds up F&I processes and increases dealer satisfaction |

|

Built-in performance analytics |

Tracks offer success rates, approval-to-book ratios, and structuring outcomes |

Enables data-driven optimization and continuous improvement |

Automating the Loan Origination Process with defi SOLUTIONS

Automated finance structuring gives you the precision of an expert underwriter, with the speed of a machine. It’s a modern must-have for any lender serious about growth, consistency, and borrower satisfaction.

See how to automate the loan origination process with a modern LOS that’s built for scale, speed, and compliance.

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. For more information on how to automate the loan origination process with smart structuring, Contact our team today and learn how our cloud-based loan origination products can transform your business.