The Top Auto Finance Industry Trends of 2025

Lenders are facing a complex blend of fluctuating interest rates, shifting borrower expectations, and a cautious credit environment where demand remains strong, but lenders are being more selective. Further, fraud is growing more sophisticated, and EVs are reshaping how residual value is calculated. In 2025, vehicle financing is testing every lender’s agility, strategy, and digital readiness.

This article explores the top auto finance industry trends of 2025 and what they signal for the road ahead. For lenders aiming to optimize their operations, these insights offer a look into what to monitor, what to challenge, and where to invest next.

Top Auto Finance Industry Trends for 2025 |

||

|---|---|---|

|

Trends |

Risk & Challenges |

Strategic Opportunities |

|

Declining EV incentives force smarter lending tactics |

|

|

|

Lending standards cautiously loosen |

|

|

|

Loan terms get longer, down payments shrink |

|

|

|

Delinquencies are rising |

|

|

|

Fintech lenders gain ground |

|

|

|

Automation & AI remain lenders’ best defense |

|

|

Declining EV Incentives Force Smarter Lending Tactics

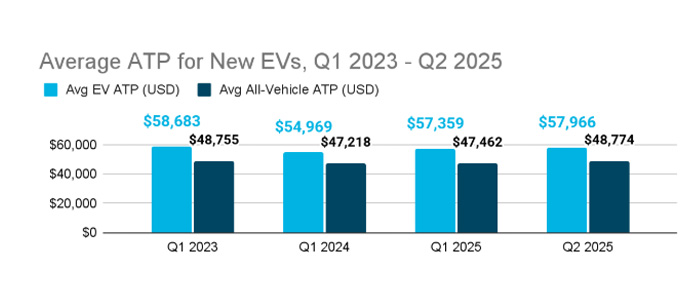

Electric vehicle adoption continues its steady climb in 2025. Nearly 300,000 EVs were sold in Q1, according to Kelley Blue Book—a 10.6% year-over-year increase. EVs made up 7.5% of all new vehicle sales, up from 7% in the same period in 2024. While Tesla’s overall sales dipped nearly 34% year-over-year, its Model Y still remains the best-selling EV on the market.

But with federal tax credits phasing down and sticker prices still hovering above gas-powered counterparts, lenders are rethinking how they approach EV loans. The average transaction price (ATP) for new EVs topped $57,737 in May 2025, compared with a national average of about $48,799 for all new vehicles. Financing EV tends to involve requiring larger loans, longer terms, and more strategic underwriting.

EVs also come with their own risk profile: steeper depreciation curves, unfamiliar residual values, and evolving battery warranty structures that complicate traditional risk models.

Lenders that remain in the game are building custom EV programs with adjusted credit models, higher residual forecasts, and specialized servicing plans. Some are even partnering directly with original equipment manufacturers (OEM) or dealers to provide bundled financing that includes chargers, maintenance, and insurance.

Looking Ahead At EV Lending

As EVs move from niche to mainstream, lenders who treat them like traditional vehicles risk being left behind.

Competitive advantage will come from flexible loan products, smarter risk modeling, and partnerships that span beyond the loan itself. Expect to see more lenders bundling value-added services (e.g., at-home charging installation, prepaid maintenance) to reduce borrower friction and improve retention.

Lending Standards Cautiously Loosen

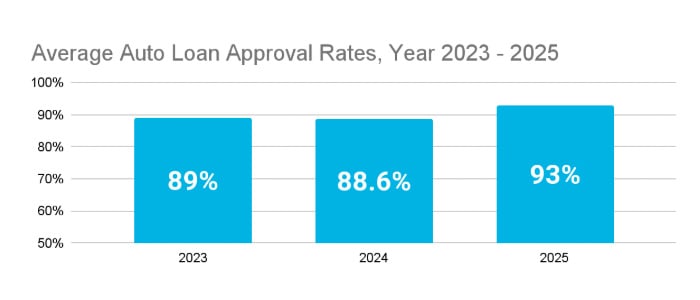

In June 2025, the auto loan rejection rate fell to 7%, implying an acceptance rate of about 93%. This is a sharp improvement from February this year, when rejection rates were closer to 14% (about 86% acceptance). For context, the annual average for 2024 was around 11.4%, or roughly 88.6% acceptance. This swing in approval rates during the first half of 2025 denotes that credit standards are easing for auto borrowers.

Lenders aren’t throwing caution to the wind, but many are starting to adjust their approval models to keep up with renewed buyer demand and mounting competition. The biggest shift is happening in the prime and near-prime tiers, where stable income and solid credit histories make it easier to approve loans with faster turnaround and better terms.

That doesn’t mean we’re back to pre-pandemic risk tolerance. Even as standards relax, lenders are pairing approvals with smarter

Looking Ahead at Credit Availability

As credit standards continue to loosen, the focus won’t just be on approving more loans—it’ll be on approving the right ones. Expect lenders to lean even harder on real-time data, alternative credit signals, and AI-assisted decisioning to expand access responsibly.

Those who strike the right balance between volume and vigilance will be better positioned to grow share without sacrificing portfolio health.

Loan Terms Get Longer as Down Payments Shrink

Borrowers are stretching their budgets to manage rising vehicle prices, and the loan structures reflect it. According to Edmunds, one in five new-car buyers now commits to a seven-year loan in Q1 2025, up from 15.8% in the same quarter last year.

Loan Term Comparison: 2024 vs 2025 |

|||

|---|---|---|---|

|

Avg % 7-Year Loans |

Avg Down Payment |

||

|

2024 |

2025 |

2024 |

2025 |

|

15.8% |

22.4% |

$6,579 |

$6,433 |

Average down payments are also slipping. Edmunds reports that the average new-vehicle down payment dropped from $6,579 in Q2 2024 to $6,433 in Q2 2025. With the average price of a new vehicle hovering around $48,799, this puts the typical down payment closer to 10–13%, well below the long-standing 20% benchmark often cited in traditional affordability guidelines.

Together, these shifts suggest that many buyers are adjusting loan terms and upfront costs to stay within budget, an affordability strategy that may keep monthly payments manageable but increase interest costs over time.

Looking Ahead at Loan Structures

As vehicle prices remain elevated, longer loan terms and lower down payments are likely to stay the norm, especially for buyers without trade-ins or substantial savings. While this helps with monthly affordability, it also means more borrowers could end up upside down on their loans, particularly if depreciation outpaces equity build-up.

Lenders aiming to manage this risk will need to go beyond FICO scores and factor in income stability, payment-to-income ratios, and vehicle type when structuring offers. Expect to see a continued emphasis on flexible term lengths, add-on protections, and smarter underwriting tools that align both lender and borrower incentives over the life of the loan.

Delinquencies Are Rising

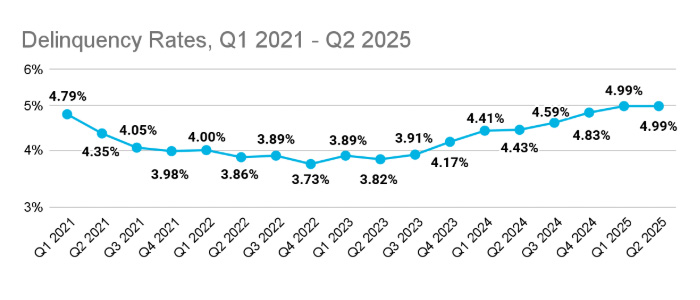

Auto loan delinquencies are climbing in 2025, signaling growing financial strain among borrowers and renewed caution among lenders. According to the New York Federal Reserve, 2.93% of auto loan debt entered serious delinquency (90+ days past due) in Q2, up slightly from 2.88% in the same period last year. However, other sources reveal more concerning movement, showing that nearly 5% of auto loans are now 90+ days delinquent.

Defaults are rising too. In April 2025, the auto loan default rate surged 20.1% month-over-month, reaching an annualized 3.49%—the highest mark in over a decade. Subprime borrowers, already under pressure from inflation and tight budgets, are disproportionately represented in these figures.

The payment burden is rising fast. According to Edmunds, a record 1 in 5 new-car buyers is now committing to a monthly payment of $1,000 or more—up from just 15.8% a year ago. These high payments are often tied to extended loan terms of 72 to 84 months and high interest rates, leaving borrowers with little flexibility if unexpected expenses arise.

For lenders, this is a signal to lean harder on predictive analytics, tighten risk management in vulnerable credit segments, and revisit collections strategies to contain losses before they escalate.

Looking Ahead at Rising Delinquencies

The convergence of higher monthly payments, longer loan terms, and inflationary pressure is creating a more fragile borrower environment. As delinquencies and defaults creep upward, lenders cannot rely solely on traditional credit scoring and reactive collections. The current landscape demands sharper forecasting tools, earlier intervention models, and greater agility in loss mitigation.

Expect more lenders to revisit their affordability criteria, especially for subprime and near-prime borrowers, and invest in analytics that flag repayment risk before it materializes. Programs that were once growth-focused may shift toward portfolio preservation, with increased scrutiny on $1,000+ payment segments and longer loan terms that push consumers closer to the edge.

Fintech Lenders Gain Ground

Fintechs are reshaping auto finance by offering streamlined applications, faster credit decisions, and intuitive digital experiences. These features resonate with younger borrowers and those frustrated by traditional banking friction.

Their embedded lending models often enable prequalification directly within dealership websites or OEM digital storefronts, making the financing experience feel more integrated and immediate.

Some platforms are scaling fast: Upgrade, for example, surpassed $1 billion in auto loan originations in 2025, doubling its 2024 total in just six months. This growth signals rising demand for alternative financing and growing trust in tech-enabled underwriting.

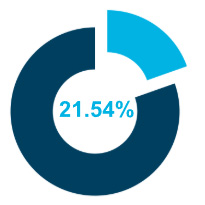

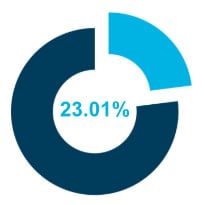

Fintech’s Market Share in Lending, 2020 vs 2025 |

|

|---|---|

|

2020 |

2025 |

|

|

Unlike traditional lenders, fintechs tend to assess risk using nontraditional data like real-time cash flow, rental history, or account insights. This broadens access for near-prime and credit-thin borrowers, positioning them as a competitive force in a tightening market.

Looking Ahead at Fintech Auto Lending

As fintech lenders continue to grow, expect deeper partnerships with dealerships, more embedded finance solutions, and broader access for underserved segments. In order to keep pace with borrower expectations for speed, personalization, and convenience, traditional lenders will need to adapt by either:

- Investing in their own digital capabilities

- Partnering with fintechs

Automation and AI Remain Lenders’ Best Defense

The demands of 2025 auto lending are driving lenders to adopt AI and automation across every stage of the loan lifecycle.

AI-powered underwriting & loan origination

Modern LOS now comes equipped with AI-powered tools that transform how lenders assess risk and process applications. Instead of relying solely on static credit scores or manual review, AI models analyze trended credit data, income patterns, payment history, and even behavioral signals to paint a more complete picture of borrower risk.

eContracting & Workflow Automation

Digitized contract workflows are rapidly becoming the norm in auto lending. Over the past four years, eContracting adoption has surged by 116%, according to data from Wolters Kluwer, signaling an industry-wide shift toward faster, paperless loan fulfillment. With eContracting, lenders can eliminate physical signatures, manual scanning, and in-person handoffs, compressing what used to be a multi-day process into minutes.

Borrowers can review and sign documents remotely, dealers can finalize deals faster, and lenders get cleaner, tamper-resistant records for compliance and auditing.

Fraud detection at scale

Fraud exposure in auto lending is surging. According to Point Predictive’s 2025 Auto Lending Fraud Trends Report, auto lenders face an estimated $9.2 billion in total fraud loss exposure in 2025.

First-party misrepresentations, such as inflated income or employment claims, accounted for the lion’s share—about 69% of total fraud risk. AI-powered defenses are stepping up accordingly.

By analyzing application patterns, transaction anomalies, and borrower behavior in real time, these systems can detect synthetic identities, forged documents, and early indicators of bust-out or credit-washing schemes, before they evolve into costly defaults.

Chatbots & Virtual Agents

AI-powered chatbots and virtual agents are now central to auto lenders’ servicing strategy. These tools handle routine borrower interactions such as payment reminders, payoff requests, document status updates, and basic troubleshooting.

At leading U.S. financial institutions, 70% of Tier 1 customer queries—like payment dates, balance, and document tracking—are now handled by AI-powered agents, which frees up time for employees to focus on complex borrower needs.

As borrower expectations continue to shift toward self-service and 24/7 availability, AI virtual agents help lenders meet demand without compromising on speed or quality.

Looking Ahead at AI in Lending

AI and automation are long-term performance drivers. As competition intensifies and delinquency risks rise, lenders with AI-enabled systems will gain an edge in both agility and resilience. Expect deeper integration of machine learning into origination, servicing, and collections.

Turn Trends into Your Competitive Edge with defi

From rising delinquencies and record-high monthly payments to the growth of fintech challengers and AI-driven underwriting, 2025’s top auto finance trends point to one thing: the old playbook isn’t enough. Lenders need smarter, faster, and more adaptive solutions to stay ahead of risk and borrower expectations.

The lenders winning in 2025 are the ones embracing change: digitizing workflows, fine-tuning credit models, and using automation to protect margins while scaling smarter.

defi SOLUTIONS wants to help you see what that looks like in action.

Book a demo today and discover how modern lending technology can help you turn market pressure into a competitive edge.

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. For more information on top auto finance industry trends, contact our team today and learn how our cloud-based loan origination products can transform your business.