Credit Union Digital Transformation

Strategy: Key Steps

The lending industry is becoming more competitive, with credit unions competing with banks, captive lenders, and online-only lenders. Despite these challenges, executives say there’s much to gain from digital transformation. The most commonly cited benefit was the increase in efficiency and reduction of errors at 35%. This was more than double the next highest answer at 13%, reduction in compliance violations.

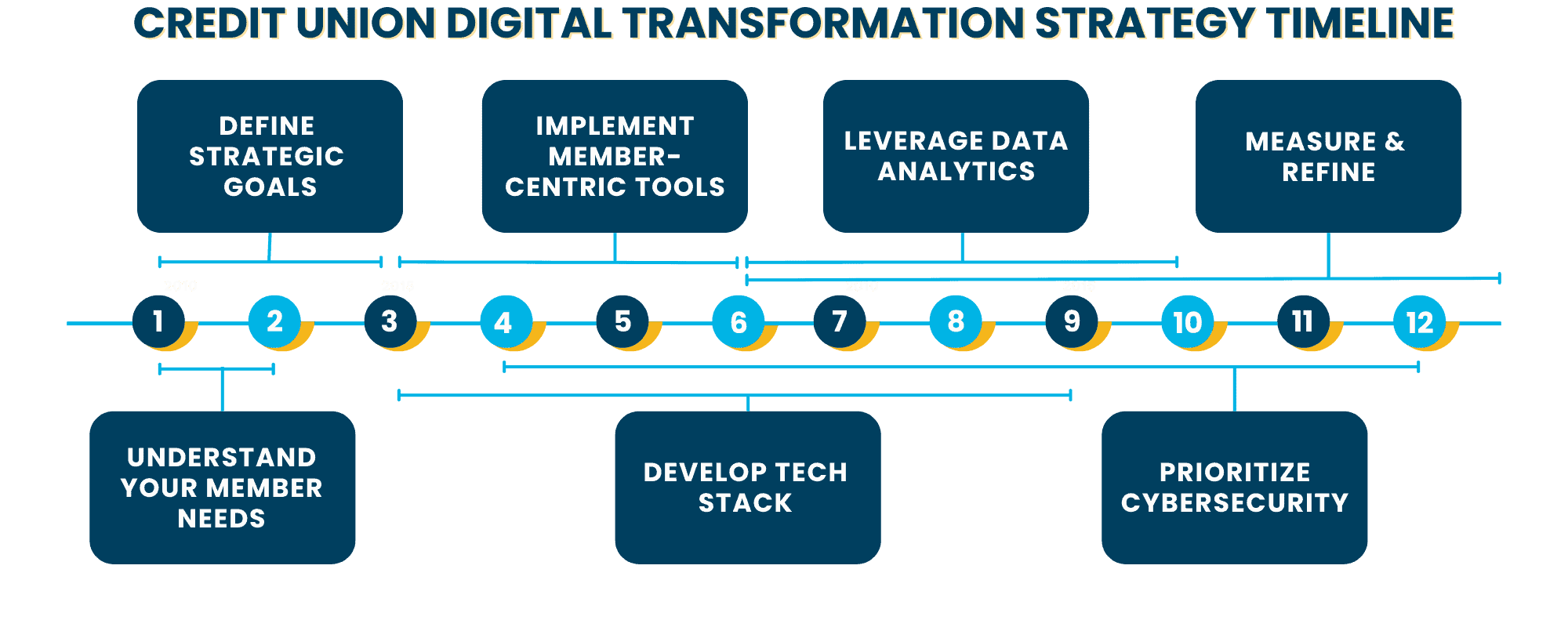

This environment makes a forward-looking credit union digital transformation strategy more important than ever. Below are 10 key steps to creating and implementing a digital transformation strategy.

|

Credit Union Digital Transformation Strategy: 10 Key Steps for Success |

|||

|---|---|---|---|

|

# |

Step |

Description |

Investment Required |

|

1 |

Understand Member Needs |

Examine current processes and how they affect member experiences |

Low-medium |

|

2 |

Define Strategic Goals |

Outline your objectives for the transformation |

Low |

|

3 |

Implement Member-Centric Tools |

Consider member-facing tech options like dashboards, apps, and digital wallets |

Medium-high |

|

4 |

Develop your tech stack |

Evaluate scalable LOS, core, and CRM systems |

High |

|

5 |

Leverage Data Analytics |

Use real-time reporting to improve decision-making and portfolio oversight |

Medium |

|

6 |

Prioritize Cybersecurity |

Protect member data and operations with robust security measures |

Medium |

|

7 |

Measure and Refine |

Compare tracked KPIs against industry benchmarks and set improvement plans |

Low-medium |

These steps ensure a structured approach to credit union digital transformation by balancing technology innovation with member service.

1. Understand Member Needs (Months 1-2)

Credit union digital transformation strategy begins with an examination of your existing practices and how they affect your members. Consider how their demographics, financial goals, and service expectations factor into their decision to be part of your credit union.

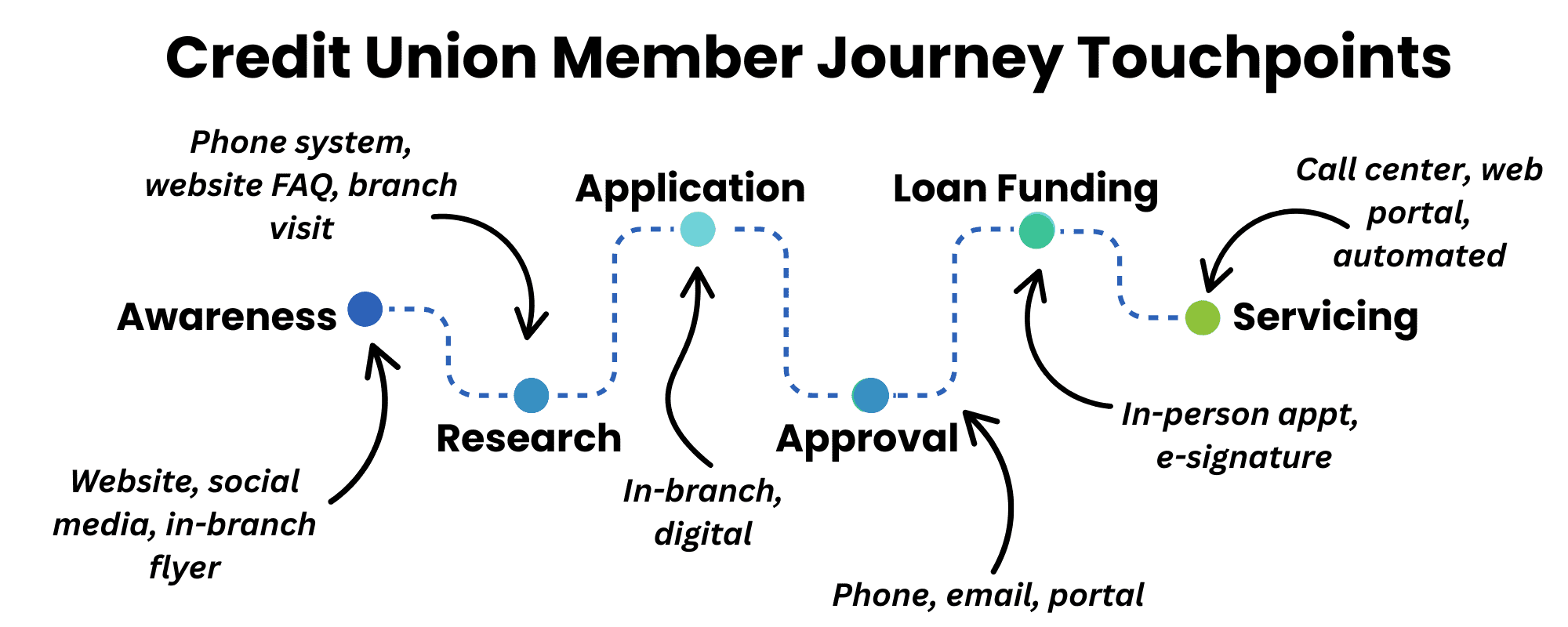

Most importantly, consider what the application process looks like for prospective and current members, specifically in terms of the touchpoints they interact with as they begin:

Assess the member journey across these touchpoints to identify areas of opportunity and expand the methods by which your credit union can communicate with prospective and existing members.

Note: Consider the digital literacy of your members and prospective members in your area; the tech updates listed in this plan may need to be adjusted for your credit union if you are working with a more traditional member base. In these instances, credit unions must carefully balance accessibility and ADA compliance with a more conventional approach.

2. Define Strategic Goals (Months 1-3)

Once you have a sense of where your members are, it’s time to start thinking about where you want them to be. Goals for credit unions vary on a number of factors (e.g., size, location, clientele), but a few common examples include:

|

Credit Union Digital Transformation Strategy: KPIs to Watch |

||

|---|---|---|

|

KPI |

Example |

Relevant KPI |

|

Increase Digital Engagement |

“Raise mobile usage by 20% over 12 months” |

Digital Adoption Rate |

|

Shorten Turnaround Times |

“Reduce decision-making time to <12 hours” |

Origination Turnaround |

|

Grow Membership |

“Increase membership by 10% by Q1 2026” |

% New Members |

|

Improve Operational Efficiency” |

“Automate 40% of processes by 2027” |

Average servicing cost per loan |

|

Enhance Member Financial Wellness |

“Launch personalized budgeting tools by Q3 2025” |

Usage of financial wellness tools |

In addition to being relevant to your credit union’s mission, your goals should also be actionable. Smaller credit unions, for example, should focus on conservative growth sustained over time rather than a spike over a shorter time frame.

3. Implement Member-Centric Tools (Month 3 - Month 6)

A large portion of contemporary credit union members prefer having digital options to manage their loans. Begin this process by learning about member needs and behaviors through surveys, focus groups, and data analytics. Get their opinions on member-facing solutions like:

- Personalized financial dashboards

- Financial education tools

- Virtual advisors

- Digital wallets

These options boost engagement by enhancing the member experience. In addition, they provide credit unions with the tools to attract new members by offering a more personalized and seamless member experience. This conjecture assumes you have a robust tech stack, as described in the section below.

4. Develop Your Tech Stack (Month 3 - Month 9)

In addition to AI-driven chatbots and mobile apps, modern credit unions rely on a wealth of technology for banking management services. A digitized tech stack for credit unions might look something like:

|

Credit Union Tech Stack Breakdown |

||

|---|---|---|

|

# |

Layer |

What it does |

|

1 |

Core Banking System (CBS) |

Oversees deposits, withdrawals, and monitors transaction data |

|

2 |

Loan Origination System |

Provides application intake, underwriting, and automated decisions |

|

3 |

Loan Servicing System |

Handles payment processing and provides delinquency workflows |

|

4 |

Digital Banking Platform |

Facilitates remote deposits, loan management, and personal finance tools |

|

5 |

CRM & Member Engagement |

Provides member services and data for marketing support |

|

6 |

Integration & Middleware |

Bridges legacy systems and modern SaaS options |

|

7 |

Business Intelligence & Reporting |

Aggregates real-time data to track KPIs and evaluate performance |

|

8 |

Cybersecurity & Compliance |

Monitors identify verification, KYC support, and enable fraud detection |

|

9 |

Payment & Funds Movement |

Facilitates ACH, bill pay, card issuing, & digital wallet support |

If you plan on working in-house, scaling your IT team in proportion to your tech stack will be critical. End-to-end loan servicing solutions can handle vulnerabilities in your infrastructure (see the cybersecurity section below), providing these tools on credit unions' behalf to reduce costs and keep systems automatically updated.

5. Leverage Data Analytics (Month 6 - Month 10)

Some aspects of your tech stack (discussed in the previous section) require special attention; the following two sections cover these needs.

A comprehensive data analytics engine allows credit unions to evaluate member behavior, portfolio performance, and product profitability while enabling efficient data-driven decision-making.

Some real-world examples include:

- Detecting early signs of loan risk: By analyzing behavioral trends (e.g., missed payments + declining direct deposits), you can flag members likely to become delinquent.

- Optimizing promotions: Identify which members are more likely to respond to HELOC campaigns based on home value + loan history + engagement.

- Improving mobile UX: Spot high drop-off rates in the online application funnel, and fix friction points in the mobile app.

- Forecasting branch closures or expansions: Use geographic product usage + digital channel adoption to guide strategic planning.

Pay special attention to your core system, BI tools, data warehouses, and CDPs; these systems, in particular, will help provide employees with insights to improve your credit union’s infrastructure.

6. Prioritize Cybersecurity (Month 4 - Month 12)

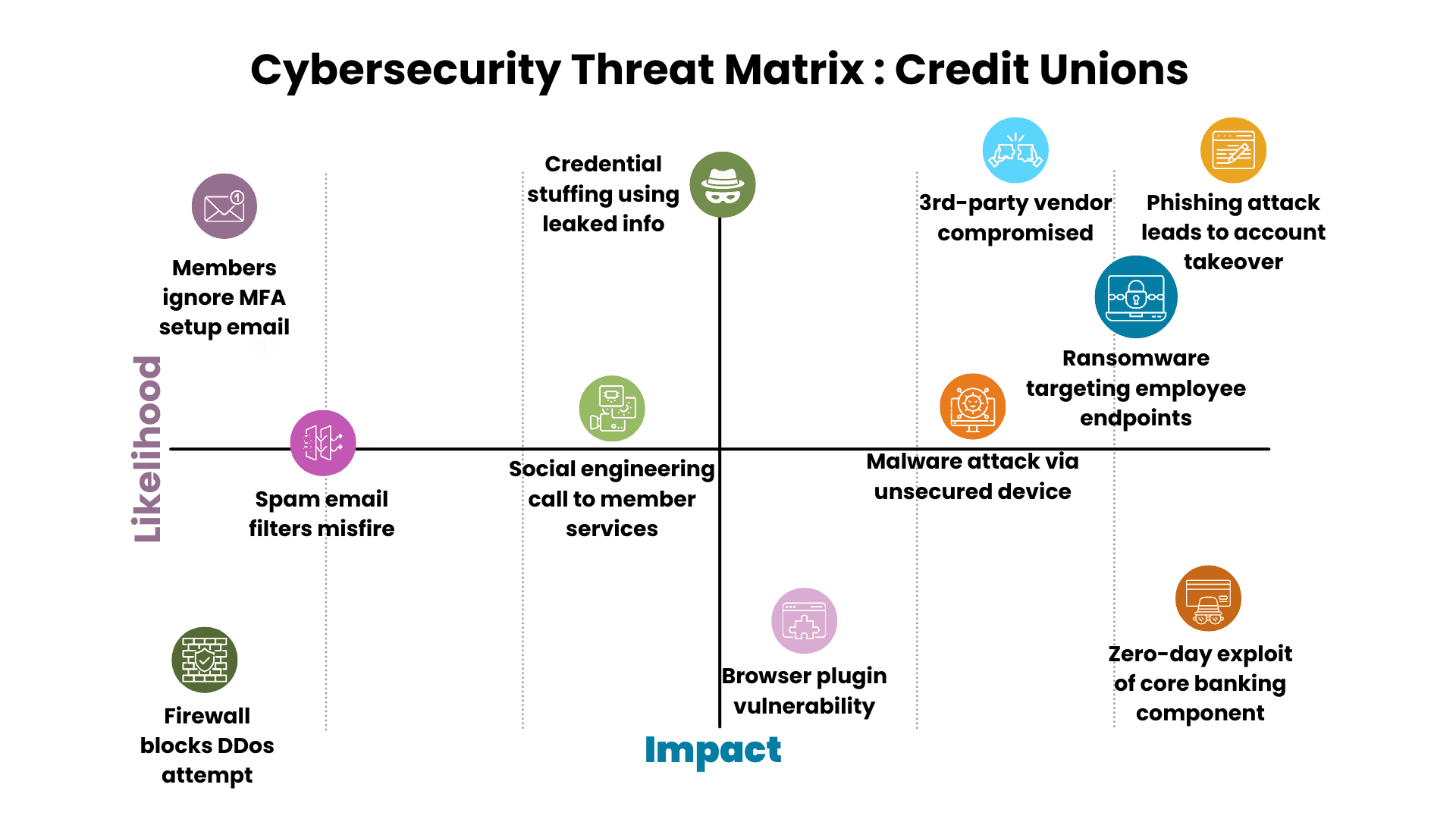

Credit unions are subject to a host of cybersecurity threats, although some are more common (and some more impactful) than others:

The most common cybersecurity threats involve some level of user error: ignored emails, phishing attacks, and malware. These threats make it critical to have systems in place for identity verification and fraud detection. The exact nature of your security stack varies depending on your needs, but a few good general practices include:

- Multi-Factor Authentication (MFA): Requiring multiple successful authentications before allowing a user to access their account.

- Fraud alerts: Automated fraud alerts minimize response times, reduce financial loss, stop account takeovers, and support greater transparency.

- OFAC/KYC checks: Required under BSA/AML regulations (Bank Secrecy Act & Anti-Money Laundering), these processes allow for stronger onboarding practices and management of larger loans.

- Endpoint security: In an increasingly digital environment, membership has considerably more devices attached to an account (e.g., computers, phones, tablets). Endpoint security provides security for any device on your network, preventing breaches and allowing credit unions to work more efficiently across branches.

The practices above are key pillars of a secure digital ecosystem. A credit union digital transformation strategy allows CUs to prioritize risk management more effectively without sacrificing the user experience.

7. Measure and Refine (6 months +)

No credit union digital transformation strategy works perfectly right out of the gate; teams must carefully monitor the performance of any alterations made and see how they compare against your strategic goals.

The most effective way to do this is by watching relevant KPIs and comparing them against industry benchmarks, as described in the table below:

|

Credit Union Digital Transformation Strategy: KPIs to Watch |

|||

|---|---|---|---|

|

KPI |

Description |

Equation |

Benchmark |

|

Digital Adoption Rate |

% of members using digital tools |

|

65%-80% |

|

Origination Turnaround |

Time from completed application to credit decision/funding |

|

Digital consumer: <24hrs Auto-decision: <5min |

|

Digital Self-Service Rate |

% of member service requests without human input |

|

70%-80% |

|

Application Abandonment Rate |

% of users who begin but don’t finish an application |

|

40%-60% |

|

Net Promoter Score |

% of members likely to recommend your services |

|

30-50% |

Consistently check in on alterations made, employ routine customer surveys, and implement A/B testing to evaluate performance.

Credit Union Digital Transformation: Key Technologies

Technologies enable digital transformation. To improve member experience, boost operational efficiency, and offer competitive services, credit unions should invest in these technologies:

|

Credit Union Digital Transformation Strategy: Essential Toolkit |

||

|---|---|---|

|

Category |

Tools |

Application |

|

Modernization of Core Banking Systems |

Cloud-based core banking Open APIs |

Scalable, flexible, and faster deployment of new services |

|

Cloud Computing |

Hybrid/public cloud platforms |

Scalability, storage, and disaster recovery |

|

Digital Lending Platforms |

Streamlined loan application, underwriting, and approval processes |

|

|

Omnichannel Integration |

Unified communications platforms |

Seamless interactions across branches (e.g., websites, mobile apps, call centers) |

|

Mobile and Online Banking Platforms |

Custom mobile apps Responsive websites Digital wallets |

Real-time account access, bill payments, remote check deposits, and transfers |

|

Artificial Intelligence and Machine Learning |

AI-powered customer support Personalized financial advice |

Member satisfaction and operational efficiency |

|

Data Analytics and Business Intelligence |

Predictive analytics (CRM) tools |

Member behavior insights, personalized recommendations, and marketing optimization |

|

Robotic Process Automation |

Automation loan processing, compliance checks, and data entry |

Reduction in operational costs and processing time |

|

Cybersecurity Enhancements |

Multi-factor authentication zero-trust frameworks Endpoint detection/ response |

Protects member data and ensures regulatory compliance |

|

RegTech Solutions |

AI compliance monitoring |

Efficiency in regulatory compliance |

defi SOLUTIONS Can Help with Digital Transformation

defi’s loan origination solutions enable credit unions to leverage these digital transformation technologies to accelerate growth. A few of the features of defi’s self-configurable, highly stable, flexible, and reliable platforms are:

- Easy to customize.

- Configurable workflows, rules, policies, features, decision engine, and administrative functions with no coding.

- Automated decision-making and funding.

- Quick implementation of business decisions.

- Modern user interface that personalizes navigation and improves user experience.

- Support for complex pricing matrices and models.

- APIs and the flexibility to build and modify integrations on the fly.

Credit unions can differentiate themselves in the competitive lending landscape by leveraging cloud computing, digital lending platforms, omnichannel integration, mobile and online banking, AI and ML, data analytics, automation, and other digital transformation technologies. As these technologies evolve, digital lending will become more accessible, efficient, and inclusive, giving credit unions more power.

Getting Started

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. With defi loan origination solutions, lenders can increase revenue and productivity through automation, configuration, and integrations and incorporate data and services that meet unique needs. For more information on credit union digital transformation, contact our team today and learn how our cloud-based loan origination products can transform your business.