Credit Union Member Retention Strategies, 2025

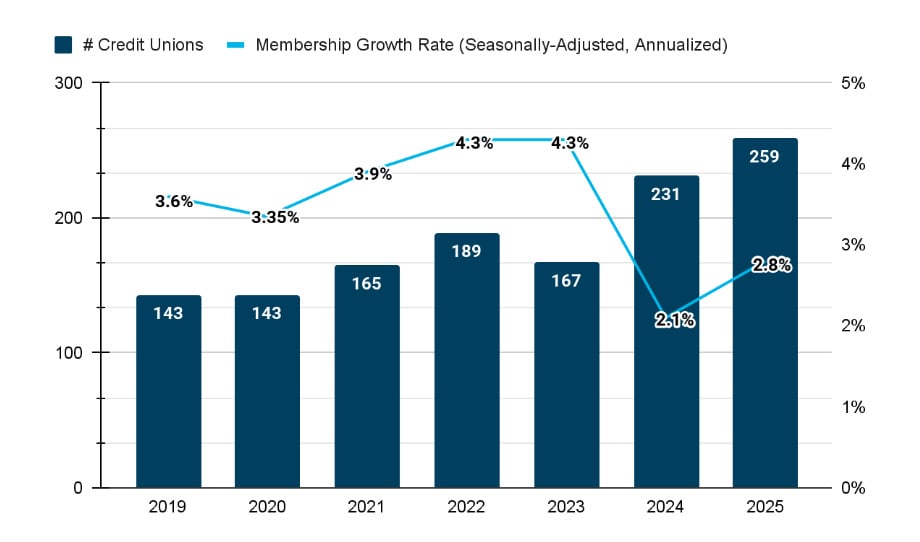

Credit unions in 2025 face a fiercely competitive market. At the same time that membership rates are slowly recovering from a record drop in 2024, the number of credit unions has continued to experience steady growth.

# Credit Unions vs Membership Growth Rate, 2019-2025

This environment makes holding on to the members you currently have all the more important. With that in mind, the following article details credit union member retention, including: how to calculate it, how to improve it, and what tools you can use along the way.

How to Calculate Member Retention Rate

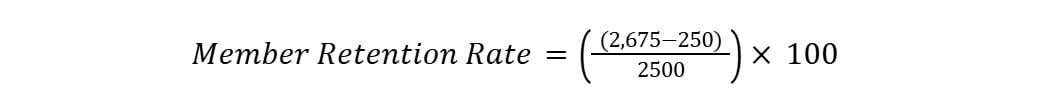

The formula for calculating credit union member retention rates is as follows:

For example, let’s say a small regional credit union measures its member retention rate over the course of Q1 2025. At the start of that period, they have 2,500 members. Over the course of Q1, they gain 250 new members; however, they lose 75, resulting in an end count of 2,675 members. Their member retention rate would look like this:

This would lead to a member retention rate of 97%, which is excellent; for reference, anything above 75% is considered a good starting point for credit unions.

Strategies to Boost Credit Union Member Retention

Now that we understand credit union member retention as a statistic, let’s take a look at how to improve it. The following sections outline four core strategies to help credit unions improve their retention rates.

Improve Communication

One of the most common reasons cited among members who decide to change their credit union is “poor communication.” Credit unions often forget to touch base with members on a regular basis to get feedback and provide notifications. Other members also noted an unfamiliarity with their account, likely a result of poor record-keeping around previous communications.

Credit unions looking to improve their communication infrastructure should consider:

- Use regular check-ins to get feedback. The simplest answer is often the most correct; if you want to improve your communication, your team needs to use it more consistently. In addition to regular check-ins (consult member behaviors to determine the best intervals), quarterly surveys should be used to assess member satisfaction and identify areas for improvement.

- Employ multiple channels of communication: Members often have preferences about how they would like to be contacted (e.g., phone, text, email). Having tools at your disposal for an omnichannel approach increases the chances of reaching them.

- Focus on the team, not any one individual: As your team shifts, the last thing you need is losing members because “they really liked working with Jennifer, and she’s not here anymore.” Make sure that members get to meet your entire team so that when an employee leaves, they don’t take members with them.

- Prioritize community engagement: Get involved with local community organizations and sponsor events (e.g., workshops, charity drives, local festivals) to get better name recognition and improve your visibility in the community.

- Using a Centralized Communication Records system: Knowing what a member already knows helps you avoid repetitive conversations and reduces the level of annoyance members might experience. Centralized communication records provide AI-driven tools for exactly this purpose.

Fundamentally, it’s all about building a bigger circle, looping in your team as well as the community around the member. Improving communication with your members is the single most important driver to improving member retention — and it can often point you in the direction of other improvements to make.

Reward Loyalty

Existing members — especially the ones who go the extra mile — deserve extra benefits that come with their membership. Loyalty programs show members that you appreciate their patronage, providing additional financial and emotional incentives to work with you.

A few suggestions for credit union loyalty programs include:

|

Loyalty Programs for Credit Unions |

|||

|---|---|---|---|

|

# |

Program |

Description |

Average Effect |

|

1 |

Member Rewards |

Cash back or points toward a purchase or gift |

10-20% higher retention as enrollment passes 50% |

|

2 |

Interest Rate Discounts |

Reduced interest for on-time payments |

Increase in member lifespan by ~2.3 years. |

|

3 |

Fee Waivers & Upgrades |

Waiving fees (e.g., ATM, credit card, origination) for loyal members or providing tiered membership levels to unlock better rates |

2x less likely to churn |

|

4 |

Personalized Offers |

Tailored rewards based on observed member behavior |

29% higher open rates 6x loan product engagement |

When considering a loyalty program, consider the complexity involved. The last thing members want is to have to “do the math” in order to get their rewards. So, construct whatever you do in such a way that makes the value immediately evident rather than something members will have to dig for.

Support

A common reason members decide to leave credit unions is their perceived instability compared to larger traditional financial institutions like banks. In reality, credit unions are more reliable and less prone to economic instability than banks, but public perception matters; credit unions wanting to fight this perception need to project the stability that members need to feel safe by providing support for members.

In this case, support systems take many forms, but a few examples might include:

- Personalized tools & advice

- Predictive forecasting

- 24/7 customer support

- Intuitive member-facing dashboards

- Omnichannel support infrastructure.

Support models for credit unions fall into two basic categories:

|

Categories of Support Programs for Credit Unions |

|

|---|---|

|

Reactive |

Proactive |

|

Responding to members that call in with a problem |

Actively reaching out to members to see if there is a problem |

More often than not, credit unions rely on reactive programs, letting their members take the lead. This model, however, also provides members with the choice to simply go somewhere else. Focusing on a proactive support model reduces these instances by anticipating needs before or as they come up.

Leverage Technology

Technology plays a vital role in increasing credit union member retention. Innovative solutions help credit unions give their members a seamless and personalized experience. With mobile apps, online banking portals, and AI-powered chatbots, members can manage their accounts anywhere, anytime. Embracing technology helps credit unions build stronger relationships with members, increase loyalty, and grow. Below are eight technologies credit unions can leverage to improve member experience and retention rates.

|

8 Technologies to Improve Credit Union Member Retention |

||

|---|---|---|

|

# |

Technology |

Benefits |

|

1 |

Mobile Banking Apps |

✔ Convenient access to accounts, transfers, and bill pay ✔ Push notifications for alerts and reminders |

|

2 |

Cloud-Based Banking |

✔ Secure online access to accounts, transaction history, and financial tools via the cloud |

|

3 |

Chatbots and Virtual Assistants |

✔ Instantaneous customer support, answering queries, and resolving issues 24/7 |

|

4 |

Data Analytics |

✔ Personalized recommendations ✔ Targeted marketing campaigns ✔ Improved risk assessments |

|

5 |

Biometric Authentication |

✔ Enhanced security and convenience for members |

|

6 |

Video Banking |

✔ Remote access to financial advisors and loan officers for personalized consultations |

|

7 |

Financial Education Tools |

✔ Online resources, calculators, and webinars to help members improve their financial literacy |

|

8 |

Gamification |

✔ Gamification elements to make banking and financial management more engaging and rewarding |

By adopting these technologies, credit unions can create a convenient, secure, and personalized experience for members. Credit unions can build loyalty by focusing on member needs with mobile apps, cloud-based solutions, chatbots, and other technologies. Credit unions that leverage these technologies will be best positioned to retain existing members and attract new ones, driving sustainable growth in a highly competitive market.

Getting Started

defi SOLUTIONS is redefining lending with software solutions and services that enable credit unions to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Members want a quick turnaround on their loan applications, and credit unions want quick decisions that satisfy members and hold up under scrutiny. With defi origination solutions, credit unions can increase revenue and productivity through automation, configuration, and integrations and incorporate data and services that meet unique needs. For more information on credit union member retention strategies, contact our team today and learn how our cloud-based loan origination products can transform your business.