Loan Management Software Features Lenders Can’t Overlook

In lending, speed and simplicity often determine whether a borrower completes an application or clicks away to a competitor. Modern loan management software (LMS) is now the backbone of that experience; it enables lenders to approve applications faster, manage risk more effectively, and deliver the digital convenience borrowers have come to expect.

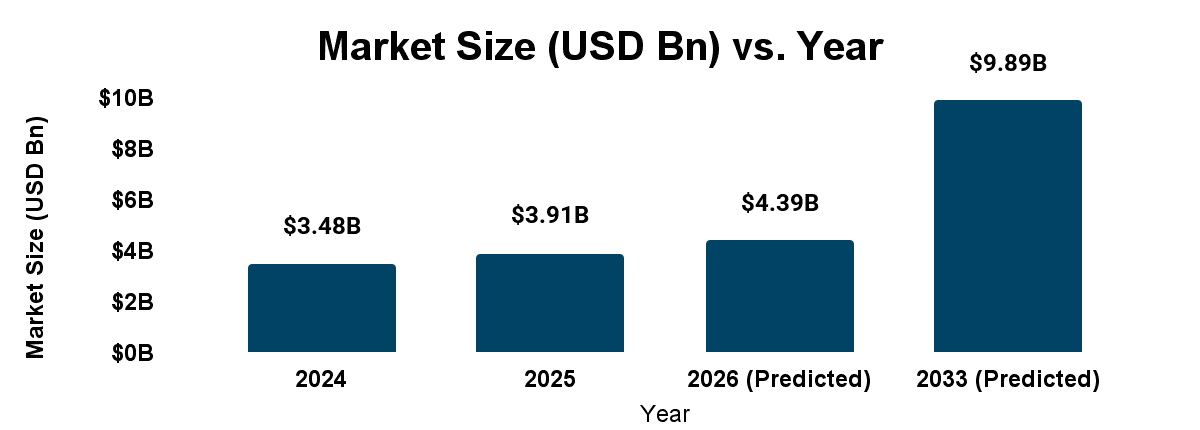

The market growth alone signals the shift: the global loan servicing software industry is valued at $4.39 billion in 2026 and projected to more than double to $9.89 billion by 2033. This is a fundamental change in how lending organizations of all sizes operate.

Below are six must-have loan management software features that define competitive loan management software in 2026, along with the benefits lenders can expect.

|

Feature |

What It Does |

Why It Matters |

|---|---|---|

|

Delivers SaaS-based, continuously updated infrastructure with open APIs for integrations. |

Cuts IT overhead, enables easy third-party connections, and scales resources up or down instantly. |

|

|

Lets lenders adjust decision rules, workflows, and product offerings without custom coding. |

Adapts quickly to market changes and supports faster product launches. |

|

|

Embeds regulatory workflows, automated disclosures, audit trails, and real-time updates. |

Reduces regulatory risk, avoids costly fines, and builds borrower trust. |

|

|

Automates underwriting, document validation, payment posting, and borrower communications. |

Speeds up approvals, lowers error rates, and expands access to credit. |

|

|

Provides dashboards tracking performance metrics, delinquency trends, and funding velocity. |

Enables proactive decisions and portfolio optimization based on live insights. |

|

|

Puts loan applications, servicing, and account management in borrowers' hands with mobile apps, self-servicing portals, e-signatures, and digital communications. |

Meets borrower demand for anytime, anywhere access. |

Cloud-Native, API-First Platforms

Scalability and integration are non-negotiable in today’s quick-paced and unpredictable lending environments. Cloud-native loan management platforms give lenders the agility to scale resources up or down, reduce IT overhead, and access continuous updates without experiencing downtime.

|

Feature |

What It Does for Borrowers |

Impact for Lenders |

|---|---|---|

|

Flexible cost models |

Borrowers indirectly benefit from lower fees and more competitive loan pricing since lenders don’t carry heavy infrastructure costs. |

SaaS subscriptions eliminate upfront investments, letting lenders pay only for what they use. This reduces waste during quiet periods and ensures affordability as volumes grow. |

|

Continuous updates |

Borrowers see fewer delays from outdated systems and enjoy smoother, more reliable servicing. |

Security patches, compliance workflows, and new loan management software features are deployed automatically, keeping lenders aligned with regulations and reducing IT strain. |

|

Easier integrations |

Borrowers experience seamless onboarding and account servicing when lenders integrate with CRMs, payment systems, and fintech apps. |

API-first design simplifies connectivity to third-party providers, streamlining processes and eliminating data silos. |

|

Global accessibility |

Borrowers can access accounts and support anytime, anywhere, which is especially valuable for remote or international customers. |

Lenders gain secure, real-time access for staff and customers across geographies, enabling flexible, remote servicing models. |

With the loan servicing software market on track to nearly triple by 2033, cloud-native platforms have advanced from a “nice-to-have” to an essential infrastructure.

Configurable Software for Scalability and Flexibility

Modern loan management systems give lenders the agility to respond quickly to changing borrower expectations, credit policies, and market conditions. Instead of relying on rigid workflows or vendor intervention, configurable software puts control in the lender’s hands.

|

Feature |

What It Does for Borrowers |

Impact for Lenders |

|---|---|---|

|

Adjust credit policy rules in real time |

Borrowers benefit from faster, more consistent approvals as credit policies adapt immediately to shifting market conditions, like changing interest rates or updated credit thresholds. |

Lenders can instantly configure debt-to-income (DTI), loan-to-value (LTV), or risk categories, ensuring credit policies always reflect current market realities and reduce unnecessary declines. |

|

Create custom workflows |

Borrowers see smoother experiences because workflows are tailored to their specific loan type, such as auto, personal, or subscription-based financing, without unnecessary delays. |

Lenders can build origination and servicing processes by loan product, borrower profile, or channel, improving efficiency without disrupting existing systems. |

|

Scale up or down |

Borrowers get consistent service during peak periods (like tax season or promotional campaigns) without delays or backlogs. |

Lenders avoid being locked into rigid infrastructure by adding features or capacity during busy times and rolling back during slower periods, controlling costs while maintaining service levels. |

|

Launch new products faster |

Borrowers gain quicker access to innovative financing options, such as EV loans or green credit products, without long wait times for rollout. |

Lenders reduce time-to-market for new offerings, capturing emerging opportunities before competitors and expanding portfolio diversity. |

For small and mid-sized lenders, configurability levels the playing field with larger institutions. For national banks, it enables agility that legacy platforms simply can’t match.

Security and Compliance by Design

With data breaches and regulatory enforcement at record levels, lenders can’t afford gaps in compliance or cybersecurity. Modern LMS platforms embed compliance frameworks into everyday workflows, automatically updating processes as federal and state regulations evolve. Instead of reacting to issues after the fact, these systems keep lenders ahead of regulatory risk.

|

Challenge |

How Modern Loan Management Software Solves It |

Key Benefit |

|---|---|---|

|

Manual disclosures and risk of human error |

Automated disclosures and pre-built templates for TILA, Reg Z, and other requirements |

Reduces compliance mistakes and costly enforcement actions |

|

Lack of visibility during audits |

Audit-ready reporting with role-based access, immutable logs, and detailed trails |

Provides transparency and demonstrates due diligence during exams |

|

Vulnerability to data breaches or outages |

Data encryption and redundancy are aligned with SOC 2 and ISO 27001 standards |

Ensures business continuity and protects borrower information |

|

Constantly changing regulations |

Real-time regulatory updates that auto-adapt to new federal and state rules |

Keeps lenders ahead of compliance changes without manual intervention |

These safeguards reduce reputational risk and give lenders confidence that every loan file can withstand regulatory scrutiny.

AI-Powered Decisioning and Automation

Lenders are increasingly relying on AI to make faster and smarter credit decisions. At Centrist Federal Credit Union, for example, automated loan approvals jumped from 43% to 63% post-AI integration, while maintaining credit quality. That kind of uplift shows how AI credit decisioning is already delivering in live auto lending environments.

|

Feature |

What It Does for Borrowers |

Impact for Lenders |

|---|---|---|

|

Automated document validation |

Borrowers experience faster approvals because income, ID, and collateral records are instantly cross-checked against databases, reducing delays from manual verification. |

Lenders shorten time-to-decision, ensure compliance with verification standards, and cut down on human error in document review. |

|

Predictive credit scoring |

Borrowers who might be overlooked by legacy scoring models gain fairer access to credit through analysis of broader data sets such as transaction histories, behavioral patterns, and alternative credit markers. |

Lenders expand their approval pool, reduce default risk, and improve portfolio performance by leveraging AI-driven risk models. |

|

Servicing automation |

Borrowers benefit from quicker updates and fewer errors in tasks like payment posting or delinquency notices. |

Lenders streamline repetitive servicing processes, lower error rates, and free up staff to focus on higher-value activities such as risk analysis or customer retention. |

|

AI-enabled contact centers |

Borrowers receive faster answers to routine questions (balances, due dates, payoff quotes) through virtual assistants, while complex issues are escalated to human agents. |

Lenders reduce call volumes, shorten wait times, and improve efficiency while maintaining personalized service for complex cases. |

By combining speed with precision, AI empowers lenders to scale operations, reduce costs, and compete in a digital-first lending environment.

Real-Time Data and Embedded Analytics

Data delayed is data wasted. Modern loan management software integrates real-time dashboards and embedded analytics, giving lenders continuous visibility into portfolio performance. Instead of waiting for end-of-month reports, decision-makers can monitor key metrics in the moment and act before small issues turn into costly problems.

|

Feature |

What It Does for Borrowers |

Impact for Lenders |

|---|---|---|

|

Approval-to-book ratios by product or channel |

Ensures borrowers applying through the most efficient channels face fewer delays or drop-offs |

Identifies which channels bring in the highest-quality applicants, reducing friction and improving conversion rates |

|

Funding velocity from approval through disbursement |

Reduces the time between approval and receiving funds |

Pinpoints workflow delays and speeds up funding, boosting operational efficiency |

|

Delinquency trends segmented by borrower type or geography |

Allows borrowers in at-risk groups to receive proactive outreach before issues escalate |

Enables early intervention strategies that reduce defaults and protect portfolio health |

|

Borrower behavior patterns |

Offers forward-looking insights that help lenders act before problems escalate |

Provides predictive insights to trigger outreach and risk alerts before delinquency grows costly |

Along with day-to-day oversight, integrated analytics also support long-term strategic planning. Lenders can identify which loan products deliver the highest margins, analyze how restructuring or modification programs affect portfolio performance, and optimize marketing spend by focusing on high-quality acquisition channels. In short, embedded analytics transform data from a lagging indicator into a proactive tool for growth and risk management.

Mobile-First and Paperless Borrower Experience

Today’s borrowers expect financial services to be as seamless as ordering groceries online or booking a flight from their phone. Loan management systems that are mobile-first and paperless meet this expectation head-on by putting control directly in the borrower’s hands, while also reducing operational friction for lenders.

|

Feature |

What It Does for Borrowers |

Impact for Lenders |

|---|---|---|

|

Self-service portals |

Lets borrowers check balances, adjust payments, or request payoff quotes anytime without waiting for business hours or call queues |

Cuts down call volume, reduces servicing costs, and increases borrower satisfaction |

|

Digital signatures and contracts |

Accelerates onboarding with secure e-signature tools, eliminating paper delays |

Speeds up loan approvals, reduces errors, and shortens time-to-funding |

|

Omnichannel communication |

Keeps borrowers connected through their preferred channels (text, email, chat, in-app) |

Improves borrower engagement, lowers missed communications, and strengthens retention |

|

Proactive alerts |

Sends reminders for due dates, early delinquency warnings, or new offers |

Helps prevent late payments, reduces delinquency rates, and drives cross-sell opportunities |

Digital lending workflows bring measurable efficiency gains for lenders. Applications move faster through underwriting, compliance checks are easier to audit, and servicing costs decline as manual processes disappear. This combination of borrower convenience and back-office efficiency makes mobile-first, digital servicing a core expectation in the modern lending climate.

How defi SOLUTIONS Powers Top Loan Management Software Features

At defi SOLUTIONS, we help lenders reimagine loan management with platforms that combine automation, configurability, and digital-first borrower engagement. Our solutions provide lenders the speed, flexibility, and compliance alignment they've needed across origination and servicing, and the agility to continue thriving in the years ahead.

We don't just deliver software. Our platform combines intelligent automation with configurable tools that help lenders eliminate repetitive tasks and adapt in real time to new borrower expectations or regulatory changes. With embedded analytics and mobile-first features, we give lenders the insight and agility they need to strengthen relationships and build frictionless borrower experiences.

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. With defi ORIGINATIONS, lenders can increase revenue and productivity through automation, configuration, and integrations, and incorporate data and services that meet unique needs. For more information on loan management software features, contact our team today and learn how our cloud-based loan origination products can transform your business.