Banking Technology Trends for 2025

Through rule-based and AI-led automation, self-service features, and other cutting-edge innovations, technology continues to solve many of the banking industry’s most pressing challenges. Unsurprisingly, financial institutions show no signs of slowing their tech investments this year.

According to a 2025 American Banker survey of 212 executives from banks, credit unions, and fintechs, more than 80% of respondents plan to increase their technology spending this year. Nearly all expect to at least maintain current investment levels. These resources will be directed across a wide range of areas, including digital payments, mobile apps, core banking system upgrades, and cloud-based infrastructure.

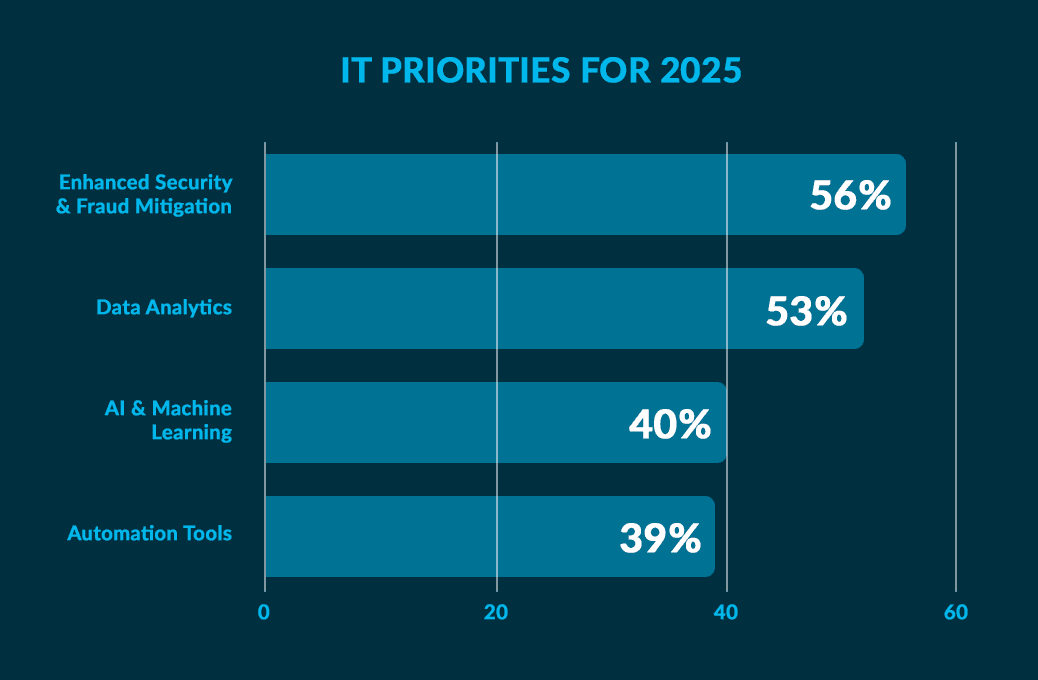

The chart below highlights the top IT priorities for 2025 based on survey responses:

As shown, cybersecurity and fraud mitigation lead the list, followed closely by data analytics, AI and machine learning, and automation tools. These priorities reflect a shared industry focus on security, smarter decisioning, and increased operational efficiency.

With these priorities in mind, let’s take a closer look at the top banking technology trends shaping 2025:

|

Top 8 Banking Technology Trends for 2025 |

|||

|---|---|---|---|

|

Trend |

Description |

Use Case |

Implementation difficulty |

|

Mobile banking |

Mobile remains the preferred banking channel across all age groups. Features like mobile check deposits, card controls, and peer-to-peer payments continue to drive adoption. |

|

Low |

|

Omnichannel |

Banks are blending online, mobile, in-branch, and even video banking to offer customers a seamless journey across channels—no matter where or how they engage. |

|

Medium |

|

AI & ML |

Banks are scaling AI and ML for fraud detection, hyper-personalized product recommendations, and intelligent automation of service and operations. |

|

High |

|

Automation |

Banks are using automation to reduce manual workloads, cut costs, and improve turnaround time. |

|

Low to medium |

|

Cloud computing |

Cloud platforms are now essential for scalability, speed, and cost-efficiency. Banks are using the cloud to roll out new tools faster and foster better collaboration. |

|

Medium to High |

|

Biometric authentication |

Fingerprint, facial recognition, and multi-modal biometrics enable banks to enhance both security and convenience for customers. |

|

Medium |

|

Blockchain |

Blockchain is being piloted for faster, more transparent cross-border payments, smart contract execution, and fraud-resistant transaction verification. |

|

High |

|

Open banking |

Open APIs are fueling collaboration between banks and fintechs, giving consumers more financial control and driving personalized product offerings. |

|

High (due to regulatory and integration issues) |

Mobile Banking

Mobile banking has reengineered the way people interact with financial institutions. According to the American Bankers Association, consumers now prefer accessing their bank accounts via mobile devices—a trend especially pronounced among Gen Z, millennials, and Gen X users.

This digital-first momentum is even reshaping the physical footprint of banking. Major institutions like Bank of America, JPMorgan Chase, and Wells Fargo have been steadily closing brick-and-mortar branches as digital adoption and declining foot traffic render many locations redundant. In just one week, between March 16 and March 22, 2025, 32 bank branches shut their doors.

While the pandemic accelerated mobile banking adoption, its long-term staying power has been secured through continuous innovation. With just a few taps, users can now:

- Check account balances

- Transfer funds

- Pay bills

- Deposit checks remotely

- Apply for loans

- Send money through P2P platforms like Zelle

- Manage cards (freeze/unfreeze, set alerts, report fraud)

- Access live in-app customer support

- Schedule future payments and transfers

What’s more, today’s banking apps offer real-time transaction alerts, predictive budgeting tools, and AI-powered insights personalized to each user’s financial behavior. Contactless payment features—like mobile wallets and NFC (near-field communication)—have also expanded functionality.

Looking ahead, mobile banking is expected to become even more intelligent and intuitive. Consumers increasingly expect hyper-personalized experiences based on their financial habits and goals. They also want proactive features that anticipate needs or issues before they arise—all while maintaining high security with minimal disruption to the user experience.

Omnichannel

Think of the modern customer journey as a series of mini-episodes—brief, goal-driven interactions that can begin on one channel and continue seamlessly on another. A customer might start a mortgage application on their phone, get assistance via chatbot, follow up by phone, and finalize the process in person. To the user, the transitions should feel invisible. That’s the promise of an effective omnichannel banking strategy.

An effective omnichannel strategy weaves together multiple platforms so users can bank however and wherever they want without restarting or repeating steps.

Banks are now leveraging a wide range of interconnected channels to support this goal:

- Branches: Despite the rise of digital banking, physical branches remain essential for certain interactions. According to Rivel Banking Research, consumers still prefer visiting a branch for tasks such as resolving account issues, opening new accounts, meeting with a banker, applying for loans, or submitting documentation.

- ATMs: ATMs offer convenient, 24/7 access to routine services like cash withdrawals, deposits, and balance inquiries and reduce the need for in-branch visits for certain essential tasks.

- Online banking: Over 69% of U.S. consumers use online banking, with adoption projected to reach 79% by 2029 (Statista). It’s especially popular among Baby Boomers, who often prefer it for paying bills and transferring funds over mobile apps.

- Mobile apps: Among all generations, mobile banking apps are the most preferred way to interact with banks. Users consistently rank features like mobile check deposit and card controls—such as turning cards on/off or reporting them lost—as among the most valuable tools in banking apps.

- Telephone banking: While no longer a primary channel, phone banking still appeals to some users—especially those without reliable internet. As of 2024, 4% of U.S. consumers primarily manage accounts via phone.

- Social media: Banks use platforms like Instagram, Facebook, and X (formerly Twitter) to answer questions, share updates, and promote services. While not a transactional tool, social media supports brand engagement, especially with younger users.

- Chatbots: AI-powered chatbots, integrated into banking websites and mobile apps, assist customers with routine tasks like checking balances, resetting passwords, and answering frequently asked questions. Modern bots can also access transaction history to offer personalized help or recommend relevant products. Over 37% of Americans interacted with a bank chatbot in 2022, a number expected to grow to 110.9 million by 2026.

- Email: While Gen Z and Millennials increasingly rely on app notifications, Gen X and Boomers still rank email as a preferred way to receive account alerts, statements, and promotions.

- Video banking: Video calls offer face-to-face access to bank reps for complex needs like mortgage consultations and financial planning. As of 2023, 61% of U.S. banks offer video banking, and 54% of consumers use it for advisory services and loan processing. The video banking market is also growing rapidly—valued at $95.6 billion in 2023 and expected to reach $273.64 billion by 2030.

- Wearable devices: Some banks now offer smartwatch apps that let users check balances, get spending alerts, or locate nearby ATMs at a glance. Though adoption is limited right now, the global banking wearable market is expected to reach $28.35 billion by 2033.

As consumers grow more digitally savvy, the demand for fluid, channel-agnostic banking will only increase. A strong omnichannel strategy allows banks to meet customers wherever they are while also collecting cross-platform insights that power more personalized, efficient service delivery.

Artificial Intelligence and Machine Learning

AI and machine learning have redefined the nuts and bolts of banking, especially in daily operations, cybersecurity, and customer experience spaces. Here are a few ways they’re changing the game for banking:

- Faster and intuitive customer service: Banks are deploying AI-powered chatbots and virtual assistants to deliver around-the-clock support for customers. These tools handle everything from basic inquiries and password resets to pre-qualifying loan applications. By pulling in recent transactions and past interactions, they personalize conversations and make digital support feel more human.

- Hyper-personalized recommendations: By analyzing transaction history, life events, spending habits, and real-time behavior, machine learning engines are being used to deliver tailored recommendations and experiences.

- Fraud detection and risk monitoring: AI is now a frontline tool in fraud detection. ML algorithms flag anomalies like unusual login patterns or unexpected purchases and automatically trigger security protocols. A PYMNTS survey shows that 77% of U.S. consumers expect their banks to use AI to proactively prevent fraud—a demand that’s fueling rapid investment. In fact, the global AI in fraud detection market, valued at $15.1 billion in 2024, is projected to grow approximately 55% to reach $23.4 billion by 2026.

- Operational efficiency: AI models are helping banks automate back-office functions like document processing, underwriting, credit scoring, and compliance monitoring. This reduces the manual workload and shortens turnaround times for high-volume tasks.

With AI tools becoming more accessible, more institutions are moving from experimental use cases to enterprise-wide deployment—fueling innovations that deliver stronger fraud prevention, hyper-personalized customer experiences, and faster, more cost-effective operations.

Automation

In the banking industry, automation has become a cornerstone of efficiency. By automating repetitive, rule-based processes such as data entry, document processing, and transaction reconciliation, banks streamline workflows and reduce the possibility of human error. This shift allows staff to focus on more complex, value-added activities that require human judgment.

Automation in the back office not only accelerates processing times but also delivers measurable cost savings. Financial institutions implementing generative AI solutions have achieved an average 22% reduction in operational costs—translating to an estimated $1 trillion in annual savings across the global banking sector by 2030.

Customer-facing automation also plays a key role in modern banking. Self-service portals and mobile apps allow users to manage routine interactions—like account inquiries, fund transfers, and loan applications—anytime, without staff intervention.

Customer service features such as chatbots and interactive voice response (IVR) systems provide real-time assistance, reducing wait times and improving satisfaction. In fact, banks leveraging generative AI in customer service have seen a 35% improvement in efficiency metrics.

The strategic use of automation in banking is thus pivotal in creating a more agile, efficient, and customer-centric financial ecosystem.

Cloud Computing

Cloud computing is making banking institutions more agile, scalable, and cost-efficient. By moving to the cloud, banks can offload the burden of maintaining on-premise infrastructure and instead tap into flexible computing power that grows with demand.

- Improved scalability and agility: Cloud platforms give banks the ability to ramp up resources during peak periods without long-term infrastructure commitments.

- Cost savings: Shifting to cloud-based systems reduces the need for expensive hardware and ongoing maintenance—unlocking both cost savings and operational agility. McKinsey estimates that Fortune 500 financial institutions alone could unlock $60 to $80 billion in annual run-rate EBITDA by 2030 through cloud adoption.

- Faster product development: Cloud infrastructure supports rapid development, testing, and deployment of new financial tools. According to PwC’s 2024 Cloud and AI Business Survey, top-performing companies using cloud technologies report significantly faster time to market and increased innovation in product and service offerings.

- Enhanced collaboration: With secure, centralized data storage, cloud computing allows teams across departments to access and analyze information in real-time. This supports faster, data-driven decisions in areas like customer service, compliance, lending, and fraud detection.

- Robust cybersecurity and compliance: Leading cloud providers offer enterprise-grade security controls, 24/7 monitoring, and regular audits that meet strict regulatory standards.

Looking ahead, cloud adoption will continue to shape the future of banking. As financial institutions prioritize speed, scalability, and security, cloud-first strategies will become the norm, not the exception.

Biometric Authentication

Biometric authentication is rapidly becoming a cornerstone of secure and user-friendly banking. Many financial institutions now use fingerprint scans and facial recognition to protect customer accounts and authorize transactions—methods that are both more secure and more convenient than traditional PINs or passwords. Here’s how biometrics are reshaping the banking experience:

- Widespread adoption: As of 2025, 87% of banks worldwide have adopted biometric authentication, moving it from a novelty to an essential part of banking security.

- Enhanced security: Biometric systems significantly reduce the risk of fraud by tying access to unique physical traits that are nearly impossible to replicate or steal.

- Improved customer experience: A recent survey found that 72% of consumers are comfortable with banks using biometrics, and 58% prefer it over passwords more than half the time.

- Operational efficiency: Biometrics cut down on verification time and reduce the burden on support staff by streamlining identity checks, especially for mobile and ATM transactions.

With advancements in AI and machine learning, biometric authentication will continue playing a critical role in balancing seamless access with airtight security—salient priorities for banks and consumers alike.

Blockchain

Blockchain technology is gaining significant traction in banking due to its potential to revolutionize traditional financial processes. At its core, blockchain enables secure, transparent transactions through a decentralized, distributed ledger. Every participant in the network has access to the same unchangeable record, which helps reduce fraud risk and enhances accountability.

- Widespread adoption: As of 2025, approximately 90% of banking organizations worldwide have adopted and initiated blockchain-related projects.

- Smart contracts: The integration of smart contracts—self-executing agreements written into code that automatically trigger actions when predefined conditions are met—has streamlined processes such as loan approvals, trade settlements, and compliance procedures. In 2025, smart contract-powered loan agreements reached $150 billion, marking a 20% year-over-year growth.

- Cross-border transactions: Blockchain technology has significantly improved cross-border payments, an area historically plagued by high fees, multiple intermediaries, and long processing times. By enabling near-instant, peer-to-peer settlement, blockchain eliminates unnecessary steps and reduces costs in international transfers. In 2024, stablecoin transaction volumes reached $32 trillion, with $6 trillion attributed to payments, accounting for approximately 3% of the estimated $195 trillion in global cross-border payments.

As blockchain technology continues to mature, its integration into banking operations is expected to expand, paving the way for a more efficient, secure, and transparent financial ecosystem.

Open Banking

Open banking enables secure data sharing between banks and third-party providers through application programming interfaces (APIs). Using this approach, third-party developers, fintech firms, and other financial institutions can securely access and leverage customer data held by banks.

The opening of APIs by banks facilitates the development of new and innovative financial products and services, fostering a more competitive and dynamic ecosystem.

- Accelerated adoption: As of early 2025, approximately 100 million Americans utilize open banking services.

- Market growth: The global open banking market is projected to expand from $30.89 billion in 2024 to $38.86 billion in 2025, reflecting a compound annual growth rate (CAGR) of 25.8%.

- Enhanced customer control: Open banking empowers consumers with greater control over their financial data, allowing them to share information with authorized third parties securely.

- Improved financial management: By aggregating data across multiple accounts, open banking facilitates better budgeting, personalized financial advice, and streamlined account management.

- Regulatory advancements: In the United States, the Consumer Financial Protection Bureau has finalized rules to promote open banking, with the aim to enhance competition and provide consumers with easier access to their financial data.

Open banking will continue to reshape the financial landscape, promote innovation, and enhance the overall efficiency of financial services as regulatory frameworks evolve to ensure customer privacy and security.

Challenges in Implementing Banking Technology

The banking technology space is undoubtedly brimming with many innovations. But rolling out next-gen solutions has its share of obstacles.

- Legacy system integration: Many banks still rely on outdated core systems that are not built for interoperability or cloud compatibility. Connecting these with modern tools—like AI, open APIs, or cloud platforms—often requires expensive and time-consuming overhauls. Without modernization, scalability and innovation hit a ceiling. In fact, 75% of banks report difficulty implementing digital solutions due to legacy infrastructure.

- Data privacy and regulatory compliance: As data sharing grows—especially under open banking—banks must traverse a web of federal and state regulations, plus evolving CFPB guidance. Maintaining customer trust while remaining compliant requires airtight data governance, secure APIs, and clear consent mechanisms. Failing to do so can result in costly penalties and reputational harm. For instance, 81% of bank customers in the U.S. and 16 other countries trust their banks to keep their data secure. However, 62% said they would lose confidence in their bank after a data breach, with 43% stating they would stop engaging with the institution.

- Cybersecurity threats: As banking institutions expand their digital ecosystems, the surface area for cyber threats grows as well. While AI-powered fraud detection has improved risk mitigation, bad actors are evolving just as quickly. Sophisticated phishing schemes, ransomware attacks, and API-based exploits are on the rise. In fact, over 75% of U.S. banks and credit unions have reported unauthorized access to their networks or data. To stay ahead, banks must invest in robust security infrastructure, real-time threat detection, and continuous monitoring.

- Customer adoption and trust: Not all consumers are enthused about embracing new technologies. Older users may be hesitant to use biometric authentication or AI-driven chatbots, while others worry about how their data is stored and used. Balancing innovation with transparency and customer education will be key for long-term adoption.

- Vendor dependency and interoperability: Relying on third-party fintech vendors for everything from APIs to biometric tools can introduce challenges related to performance, system compatibility, and shared liability. To ensure seamless integration, banks must conduct thorough vendor due diligence, enforce strong API governance, and establish clear protocols for monitoring performance and managing data-sharing responsibilities.

Still, the momentum behind digital transformation isn’t slowing. Forward-thinking banks are approaching these challenges strategically by investing in modular upgrades, prioritizing cybersecurity, and embracing partnerships that support long-term agility.

What Lenders Should Consider in Implementing a New Technology Stack

Implementing a new technology stack is a significant decision for any organization, and for lenders, it’s crucial to carefully assess various factors to ensure a smooth and successful transition. Here are some key considerations for banks when implementing a new technology stack:

Banking Technology Checklist, 2025

|

Scalability |

Interoperability |

|---|---|

|

Choose a technology stack that can scale with the bank’s growth and increasing transaction volumes. Ensure the technology allows easy integration with new services and technologies as they emerge. |

Assess the new technology’s compatibility with existing systems and the ease of integration. Ensure that the technology stack supports industry-standard APIs for seamless interoperability. |

|

|

|

User Experience: |

Performance and Reliability |

|

Prioritize user-friendly interfaces for both customers and internal users. Consider the ease of training staff to use the new technology and the availability of support resources. |

Choose technologies known for high availability and minimal downtime. Establish performance benchmarks and monitor system performance regularly. |

|

|

|

Cost Considerations |

Security, Compliance, and Regulation |

|

Evaluate the long-term costs associated with implementing and maintaining the new technology. Assess the potential benefits and returns the new technology is expected to deliver. |

Ensure the new technology complies with all relevant financial regulations and data protection laws. Prioritize robust security measures to protect sensitive customer and financial data. |

|

|

|

Project Management |

Innovation and Future Banking Technology Trends |

|

Develop a detailed and realistic implementation plan to minimize disruptions. Implement strategies to manage the organizational change associated with adopting new technology. |

Assess the vendor’s technology roadmap to ensure ongoing updates and compatibility with future innovations. Consider how well the technology stack aligns with emerging trends such as blockchain, artificial intelligence, and machine learning. |

|

|

|

Data Analytics and Insights |

Vendor Reputation and Support |

|

Ensure the technology supports effective data collection, storage, and analysis. Implement tools that provide actionable insights for better decision-making. |

Choose reputable vendors with a history of successful implementations in the banking sector. Ensure that the vendor provides reliable support services and has a responsive support team. |

|

|

By carefully evaluating these factors, banks can make informed decisions about implementing a new technology stack that aligns with their business goals, regulatory requirements, and customer expectations.

Understanding & Implementing Banking Technology Trends

From AI-driven fraud prevention to blockchain and cloud-powered agility, banking tech is evolving fast. If you’re ready to modernize your lending operations, connect with defi SOLUTIONS. Our team can help you configure a future-ready origination platform that keeps you competitive, compliant, and aligned with tomorrow’s trends.

Getting Started

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. With defi ORIGINATIONS, lenders can increase revenue and productivity through automation, configuration, and integrations and incorporate data and services that meet unique needs. For more information on banking technology trends, Contact our team today and learn how our cloud-based loan origination products can transform your business.