Outsourcing Trends for Auto Lenders in 2026

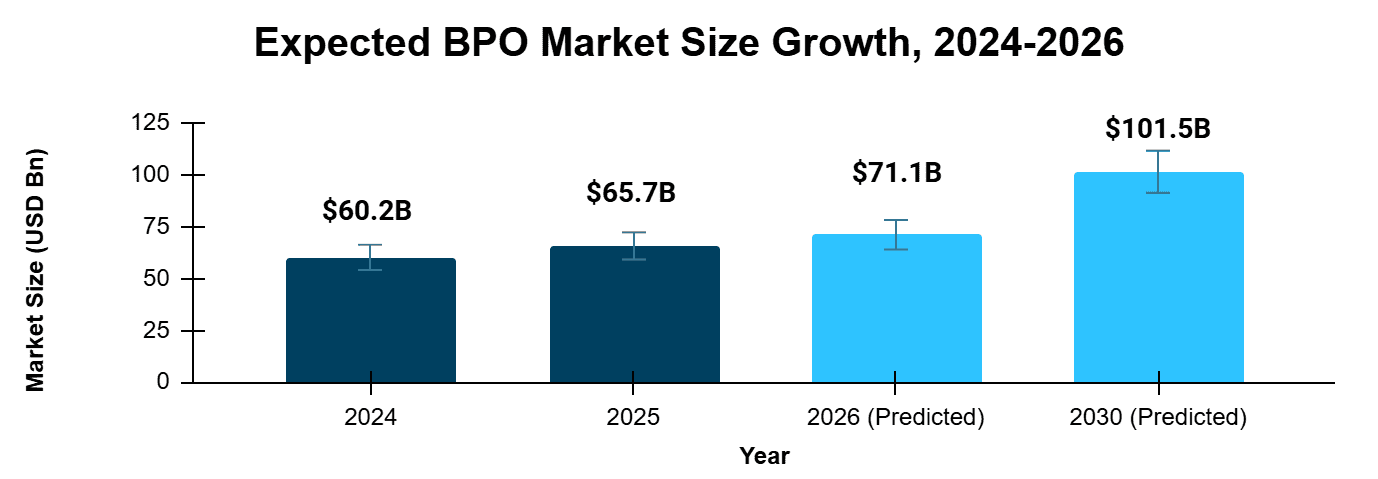

Business process outsourcing (BPO) in lending refers to outsourcing certain operational tasks across the loan lifecycle, like underwriting support, document handling, and servicing, to third-party providers or fintech partners. This practice is picking up considerable momentum in financial services. In fact, the global market for finance and accounting BPO is expected to grow from $60.2 billion in 2024 to $101.5 billion by 2030.

That’s a 9.1% growth rate year after year.

This article breaks down the major outsourcing trends for auto lenders in 2025 and the outlook for 2026, showing how they're reshaping loan servicing, day-to-day operations, and long-term growth strategies..

Trend #1: Outsourcing for Cost Efficiency

In 2025, auto lenders are increasingly realizing that keeping servicing entirely in-house means juggling unpredictable call volumes, rising wages, and mounting compliance headaches, all while trying to preserve margins in a high-rate environment.

Take a midsize lender operating in five states: They need licensed agents in each jurisdiction, a secure servicing platform, and employees trained to handle everything from payment plans to past-due collections. That’s a heavy fixed cost, especially when origination volumes fluctuate month to month.

This year, more lenders are offloading a significant share of that workload to BPO partners, without losing oversight or control. They’re outsourcing borrower support, payment processing, and early-stage collections to specialized servicing partners who can do it faster, cheaper, and at scale. Adoption is expected to expand even further heading into 2026.

How Outsourcing Delivers Efficiency

Outsourcing enables lenders to reduce operational overhead without compromising on flexibility or control. Here's where the savings come from.

|

How Outsourcing Drives Cost Efficiency |

|

|---|---|

|

Efficiency Driver |

What Outsourcing Delivers |

|

Staffing |

Eliminates fixed labor costs tied to hiring, training, and retention. |

|

Licensing & Tech |

Removes the burden of managing state licenses and maintaining servicing platforms. |

|

Scalability |

Provides on-demand support for customer service, payments, and collections without overextending internal teams. |

BPO vendors aren’t just call centers. They offer omnichannel borrower support, real-time dashboards, and integrations that rival in-house systems.

Looking Ahead

This trend will likely accelerate through 2026 as:

- Interest rate volatility and inflation drive up the cost of capital and operations

- Skilled labor shortages make internal hiring more difficult

- BPO vendors expand tech-enabled capabilities (e.g., AI-powered routing, SLA monitoring)

Trend #2: Compliance Pressures Are Fueling Strategic Outsourcing

In the current regulatory climate, the cost of a missed disclosure or misfiled notice could mean a fine, a lawsuit, a reputational hit, or even a portfolio freeze.

As outsourcing trends for auto lenders continue to evolve, compliance is becoming a major driver. Lenders are now outsourcing to keep up with the fast-changing state-level requirements, avoid penalties, and ensure operational resilience. Let’s look at the pressure points:

State-by-state variability:

Rules around fees, repossession timelines, and communications differ dramatically across states and even loan types.

- In Texas, late charges are limited by law to the lesser of $15 or 5% of the payment due after it remains unpaid for 10 or more days.

- In Illinois, after a repossession notice is mailed or delivered, the owner has 21 days to redeem the vehicle or address the debt.

- In Florida, lenders must provide at least 10 days’ notice prior to the sale of titled personal property, with a written accounting of principal, interest, and expenses.

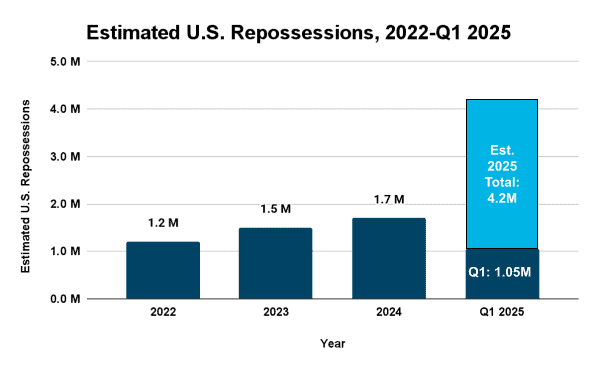

Repossession risk is rising:

The national repossession assignments reached 2.1 million year-to-date through April 2025, a 50% surge from 1.4 million during the same period in 2024. In total, the industry recorded nearly 1.73 million repossessions in 2024, signaling a sharp rise in borrower distress and collection activity.

*2025 figure reflects repossessions through April only.

The spike in repossessions is creating two layers of risk: first, a volume problem that strains internal capacity, and second, a compliance problem as lenders struggle to meet strict state-by-state notification, disclosure, and documentation requirements. Thus, many lenders are turning to third-party forwarding agents to manage this surge and reduce the risk of costly compliance failures.

Penalties are high and scalable:

Violations tied to the Truth in Lending Act (TILA), UDAAP, or servicing errors can lead to thousands of dollars in per-loan damages, especially in class action settings.

Why Outsourcing Compliance-Heavy Functions Makes Sense

To manage rising regulatory risk without overloading internal teams, many lenders are turning to outsourcing partners with compliance expertise built into their operations. Here’s where these vendors add the most value:

|

How Outsourcing Strengthens Compliance |

|

|---|---|

|

Compliance Advantage |

What Outsourcing Delivers |

|

Licensing Coverage |

Vendors hold state-specific licenses, reducing administrative and legal burden on internal teams. |

|

Workflow Design |

Built-in documentation, audit trails, and disclosure tracking streamline regulatory reviews. |

|

Operational Consistency |

Standardized servicing processes reduce compliance errors and protect against endorsement actions. |

Looking Ahead

This trend is likely to accelerate through 2026 as:

- Regulators double down on borrower protection, especially in repossession, servicing, and add-on product disclosures

- Borrower complaints become legal liabilities, not just PR problems

- Litigation risk scales, particularly for lenders operating across multiple states without centralized compliance support

Trend #3: Digital Expectations Are Reshaping Loan Servicing

Borrowers are used to applying for loans online, getting decisions in minutes, and signing digitally. When it comes time to manage their loan, however, too many are met with long hold times, paper-based processes, or phone-only support. In 2025, that disconnect is already driving attrition, and in 2026, it will be a deal-breaker.

Borrower behavior has changed, and so have their standards.

- Mobile-first preferences: A significant number of customers prefer digital communication via mobile app or desktop website for bank-related tasks.

- Real-time self-service: Borrowers want instant access to payoff quotes, payment history, due date changes, and account information.

- Omnichannel is the baseline: Borrowers expect access to email, live chat, secure SMS, and responsive web portals, not as extras, but as standard features of any modern loan servicing experience.

Falling short in any of these areas increases call volume, slows resolution times, and creates borrower dissatisfaction, risking both retention and reputation.

How Outsourcing Helps Lenders Meet the Moment

To meet rising borrower expectations without the cost and delay of building from scratch, many lenders are partnering with outsourcing providers that specialize in digital engagement. Here’s how the right BPO partner can help modernize servicing:

|

How Outsourcing Supports Digital-First Borrower Experiences |

|

|---|---|

|

Capability |

What Outsourcing Delivers |

|

Self-Service Portals |

White-labeled interfaces that integrate directly with your servicing platform. |

|

Omnichannel Support |

Chat, SMS, and email responses without expanding your internal team. |

|

Language & Availability |

Multilingual agents and extended service hours across time zones. |

|

Workflow Automation |

CRM-integrated processes for handling routine borrower requests efficiently. |

These solutions let lenders meet modern borrower expectations faster and more affordably, without compromising service quality.

Looking Ahead

This will remain a salient outsourcing trend for auto lenders into next year as

- Digital-native borrowers make up a larger share of the auto lending base, raising expectations for on-demand service and mobile-first experiences

- Fintechs and neobanks set new standards for speed, convenience, and self-service in loan and lease management

- Omnichannel servicing becomes table stakes, and lenders that rely solely on phone support risk falling behind

- Leading BPO vendors offer AI-powered chat, natural language responses, and seamless CRM integration.

Trend #4: Collections and Recovery Are Getting Smarter

Collections used to be a reactive, one-size-fits-all operation: trigger a call, hope for a payment, repeat. In 2025, that model has given way to a more strategic and technology-driven approach. With delinquency rates ticking up, lenders are feeling the pressure to modernize collections.

- Delinquencies are rising: According to TransUnion’s Q2 2025 Auto Industry Insight, 60‑plus‑day delinquencies increased to ~1.31% year‑over‑year, a smaller jump than previous quarters but still a clear indicator of repayment pressure.

- Recovery workflows are more complex: Collections now span multiple phases: pre-delinquency outreach, payment plan structuring, repossession, and post-repo remarketing, all of which require compliance, borrower sensitivity, and jurisdictional fluency.

- Third-party forwarding is the new norm: Most lenders now rely on external agents for repossession coordination. However, without strong oversight, this model introduces serious reputational and legal risk.

These dynamics are pushing lenders toward outsourced recovery partners equipped with advanced tools, multi-state licensing, and intelligent workflows that go beyond reminder calls and payment notices.

How Outsourcing Elevates Collections and Recovery

With the collections process becoming more complex and risk-sensitive, lenders are turning to outsourcing partners with specialized tools and experience across the entire recovery cycle.

Here’s how modern BPO providers enhance both performance and borrower engagement:

|

How Outsourcing Drives Cost Efficiency |

|

|---|---|

|

Efficiency Driver |

What Outsourcing Delivers |

|

Staffing |

Cuts fixed labor costs connected to hiring, training, and retention |

|

Licensing & tech |

Removes the burden of managing multi-state licenses and maintaining servicing platforms |

|

Scalability |

Provides on-demand support for customer service, payments, and collections without overextending internal teams |

Looking Ahead

Collections and recovery will remain a critical outsourcing focus into 2026 as:

- Delinquencies remain elevated because of high inflation and stagnant wage growth

- Regulators intensify oversight of third-party collection practices and borrower communication standards

- Repossession workflows demand greater transparency, documentation, and post-repo handling compliance

- AI and behavioral analytics become essential tools for optimizing outreach, segmentation, and resolution paths

Trend #5: Modular, Configurable Outsourcing Is the New Norm

Legacy BPO models often required lenders to hand off entire functions like servicing or collections. But in 2025, shift toward modular, configurable outsourcing has already taken hold. Leading vendors now offer modular, configurable services that adapt to a lender’s size, strategy, and operational maturity.

This shift gives lenders across the industry more control and better alignment between outsourcing models and business needs, whether they’re managing seasonal spikes, launching new products, or modernizing legacy operations:

- Traditional lenders: May only need overflow servicing support during holidays, nights, or periods of high volume.

- High-growth fintech lenders: Often outsource full workflows to scale quickly without building large internal teams.

- Regional banks and credit unions: Typically want to preserve borrower relationships while outsourcing backend processes like document handling, payment posting, or early-stage collections.

This demand for precision has pushed BPO partners to develop tiered, à la carte service models that blend seamlessly into existing operations.

What Modern Outsourcing Looks Like

Instead of rigid, all-or-nothing contracts, today’s outsourcing partners offer modular service options that plug into your existing operations. Here’s what modern, configurable outsourcing looks like:

|

What Modern Outsourcing Looks Like |

|

|---|---|

|

Modular Service |

What it Enables |

|

Overflow Support |

Use external servicing teams only during call spikes, weekends, or seasonal urges. |

|

Custom SLAs |

Define turnaround times, escalation paths, and quality standards to fit your risk and service model. |

|

Language & Access Options |

Add multilingual agents, after-hours availability, or borrower portals, without new internal builds. |

|

Built-In Transparency |

Monitor real-time activity, queue performance, and compliance metrics via dashboards and reporting tools. |

Looking Ahead

In 2026, expect modular outsourcing models to become the default, as:

- Lenders demand cost flexibility without sacrificing control

- Outsourcing partners invest in configurable APIs and integrations

- Compliance and service standards vary more by region, product, and borrower segment

- Internal teams grow leaner and shift focus to core differentiation vs. operational execution

Trend #6: AI-Powered Support Is Becoming a Differentiator

Outsourcing partners are embedding AI into every phase of borrower interaction, turning routine support into an opportunity for automation, insight, and early risk detection.

For lenders, this means:

- Smarter routing: AI classifies borrower intent and routes tickets or calls to the right team automatically, cutting response times and boosting first-call resolution.

- Real-time sentiment analysis: Supervisors are alerted instantly when calls go off-script or when borrower frustration rises, allowing for timely coaching or intervention.

- Virtual agents and chatbots: These tools now handle a growing share of inbound servicing requests, such as balance inquiries, due date changes, or payoff quotes, with increasing accuracy and personalization.

- Predictive collections: AI models analyze borrower behavior and historical data to identify risk patterns, helping lenders intervene before delinquency escalates.

Strategic Value for Lenders

Leading BPO partners are using AI to improve speed, compliance, and borrower experience while reducing internal workload. Here’s where AI is delivering real value:

|

Strategic Benefits of AI-Enabled Outsourcing |

|

|---|---|

|

Benefit |

What It Delivers |

|

Technology Access |

Enterprise-grade AI capabilities without internal development or infrastructure investment. |

|

Operational Efficiency |

Automation of routine tasks, freeing internal employees to focus on complex exceptions. |

|

Stronger Compliance |

Built-in monitoring, scripting, and documentation for consistent, audit-ready borrower interactions. |

|

Borrower Experience |

Faster response times, higher first-contact resolution, and more accurate support delivery. |

Looking Ahead

AI adoption in outsourced support will accelerate in 2026 as:

- Lenders prioritize cost-effective automation over labor-heavy support models

- Regulators expect higher consistency and documentation in borrower interactions

- Borrowers grow more comfortable with self-service and digital-first channels

- BPO vendors refine and expand their AI capabilities across servicing and collections

Outsourcing Trends for Auto Lenders: Explore What’s Possible with defi SOLUTIONS

The outsourcing trends for auto lenders point to a smarter, more strategic model, one that blends flexibility, compliance, and digital-first borrower engagement.

Whether you’re a fast-scaling lender or a legacy institution looking to modernize, defi SOLUTIONS offers a configurable, compliance-ready servicing platform backed by expert support teams. Our tech-enabled BPO services help you:

- Reduce cost-to-serve

- Meet regulatory requirements across all 50 states

- Support borrowers with digital, omnichannel experiences

- Scale collections intelligently and ethically

- Leverage AI and automation to work smarter, not harder

Ready to see how defi can help you reduce risk and reclaim capacity? Have a conversation with one of our representatives to learn more about our outsourcing services.

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. For more information on outsourcing trends for auto lenders, Contact our team today and learn how our cloud-based loan origination products can transform your business.