After several years of rate volatility, inventory whiplash, and credit tightening that created short-term disruption, lenders are now adapting to structural change rather than cyclical market shocks.

This article examines the key auto lending market trends shaping the industry in 2026, drawing on current data and forward-looking indicators to outline what lenders can expect over the remainder of the decade.

U.S. Auto Lending Market Size and Growth Outlook (2025–2030)

The U.S. auto lending market trends for 2026 signal that it will be one of the largest and most resilient consumer credit segments, even as affordability pressures reshape loan structures and risk profiles. While origination growth has moderated from post-pandemic peaks, total market value continues to expand as higher vehicle prices, longer loan terms, and elevated interest rates persist.

Rather than signaling contraction, these dynamics point to a market evolving toward longer-lived portfolios, higher servicing intensity, and greater execution demands across the loan lifecycle.

Key indicators shaping the outlook:

- Market size remains elevated: Outstanding auto loan balances totaled $1.655 trillion in Q3 2025, remaining near historic highs as portfolio duration extends and average balances increase.

- Origination activity remains steady: More than 12.7 million auto loans were originated in the first half of 2025, representing approximately $381 billion in funded volume, evidence of sustained consumer demand despite affordability constraints.

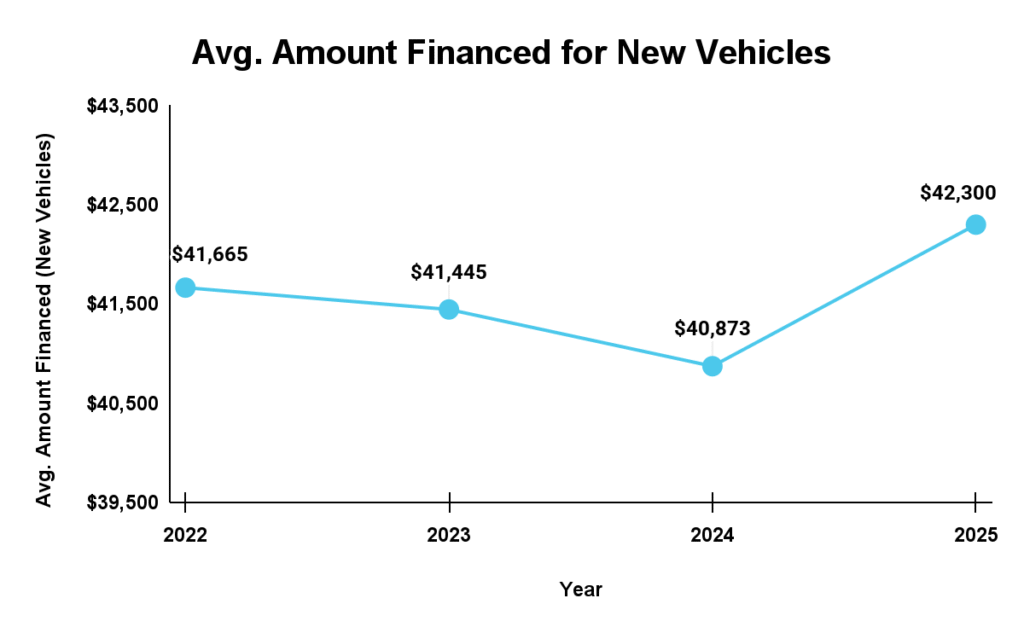

- Loan amounts continue to rise: The average amount financed for new vehicles reached $42,332 in Q2 2025, roughly $2,000 higher than in 2023–2024, driven by vehicle pricing, longer loan terms, and growing EV adoption.

Looking ahead through 2030, market growth is expected to be incremental rather than explosive, with expansion driven more by portfolio value and servicing duration than by unit volume alone. This shifts lender focus from pure origination scale to lifecycle profitability, loss mitigation, and operational efficiency.

What this trend signals for lenders:

Market growth is no longer about capturing more loans at any cost. But about managing larger balances, longer exposure, and higher servicing complexity, while protecting margin in a rate-sensitive environment.

Monthly Payment Pressure Is Reshaping Loan Structures

Even as origination volume grows, borrower affordability remains constrained. Higher vehicle prices and elevated interest rates have pushed monthly payments to levels that materially influence loan terms, approval strategies, and downstream risk.

What’s changing in the market:

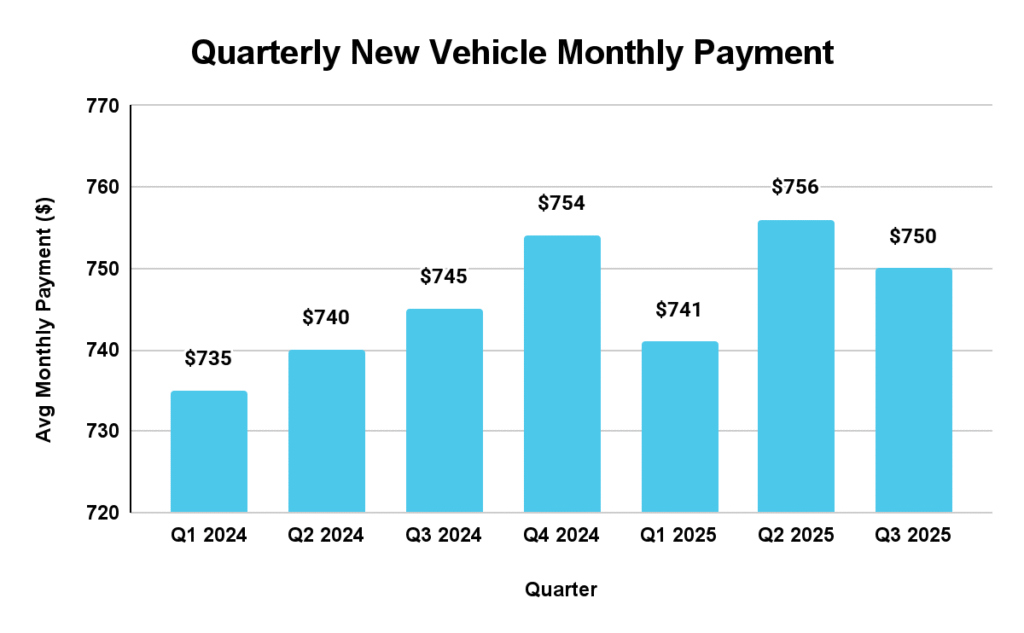

Average new-vehicle monthly payments remained near record highs, around $750 as of Q3 2025. 72–84 month loans are now common, particularly for new vehicles and higher-priced segments such as EVs.

- Loan term extension is increasingly used as an affordability lever, rather than a borrower preference.

- Payment-to-income sensitivity is rising, especially in near-prime and prime segments, as higher rates and larger financed amounts push monthly obligations closer to borrower income limits.

While longer terms help maintain origination flow, they also extend auto loan risk exposure, slow equity build, and increase loss severity if a borrower defaults early in the loan lifecycle.

What this trend signals for lenders:

Growth is now about structuring loans more carefully than simply approving them. Lenders must balance affordability with exposure by tightening PTI controls, monitoring early-cycle performance, and reassessing term-based risk models.

Servicing and Collections Pressure Is Increasing

Even without a sharp rise in delinquency, servicing demand is climbing. Portfolio growth, longer loan terms, and higher payments are increasing interaction volume earlier in the loan lifecycle, putting pressure on traditional servicing and collections models.

What’s changing in the market:

- Longer loan terms extend servicing duration, increasing cumulative workload per account.

- Higher monthly payments create early-cycle friction, driving more inquiries, extensions, and short-term assistance requests.

- Servicing activity is rising faster than delinquency, as borrowers seek flexibility before missing payments.

- Collections teams face greater complexity, even when accounts remain technically current.

While headline delinquency metrics remain relatively stable, operational strain is surfacing earlier and more consistently across active portfolios.

What this trend signals for lenders:

Servicing is becoming a cost driver earlier in the loan lifecycle, not just during downturns. Lenders must shift from reactive collections models to proactive, scalable servicing strategies that prioritize early engagement, consistency, and efficient exception handling as portfolios expand.

Fraud Risk Is Shifting Earlier in the Lending Lifecycle

As origination volume stabilizes and lenders rely more on automation and speed, auto loan fraud risk is moving upstream. Rather than appearing primarily at funding or charge-off, indicators increasingly surface during application intake, income verification, and early account activity.

What’s changing in the market:

- Application fraud is becoming more sophisticated, with synthetic identities and income misrepresentation harder to detect using static checks alone.

- Digital channels and indirect lending increase exposure to inconsistent data quality and dealer-driven risk.

- Early-cycle anomalies, such as mismatched income, rapid payment changes, or abnormal usage patterns, often precede traditional fraud flags.

- Fraud losses increasingly materialize as early defaults or rapid write-offs rather than long-tail delinquency.

While overall approval standards remain tight, fraud risk is becoming less visible at origination and more costly when detected late.

What this trend signals for lenders:

Fraud prevention must move beyond point-in-time checks. Lenders need continuous verification, cross-data validation, and early-cycle monitoring to detect risk before funding errors turn into losses. Institutions that rely solely on static rules or manual review face growing exposure as fraud patterns evolve.

Technology Consolidation Is Replacing Point Solutions

As auto lending portfolios grow more complex, lenders are shifting technology investment away from isolated point tools and toward platforms that support end-to-end execution across origination, risk, servicing, and compliance. Managing modern portfolios now requires systems that share data seamlessly across the loan lifecycle.

What’s changing in the market:

- Financial institutions continue to increase digital investment, with over 70% reporting higher spending on digital transformation initiatives, signaling a move away from fragmented systems toward integrated platforms.

- More than half of financial institutions have embedded advanced analytics or AI into core operations, reinforcing platform-level adoption rather than standalone tools.

- In auto finance specifically, digital adoption has more than doubled over the past four years, reflecting the accelerated modernization of lending infrastructure.

- Lenders are prioritizing technology that enables consistent decisioning, real-time visibility, and audit-ready workflows across channels and portfolios.

These trends reflect a clear shift in how technology budgets are being allocated: toward systems that support execution at scale, not just task-level automation.

What this trend signals for lenders:

Operational advantage is increasingly defined by integration. Lenders that consolidate workflows and data into unified platforms reduce manual handoffs, lower cost-to-serve, and respond faster to risk and regulatory change. Those relying on disconnected point solutions face rising operational friction as loan terms lengthen, payments rise, and portfolio mix becomes more complex.

Outsourced Servicing and Managed Operations Are Becoming Strategic

As portfolios expand and operational complexity increases, lenders are rethinking how work gets done across servicing, collections, and post-origination operations. What was once viewed as a tactical stopgap is now becoming a strategic component of the operating model.

What’s changing in the market:

- Longer loan terms, higher balances, and EV exposure are increasing servicing duration and touchpoints per account.

- Early-cycle borrower engagement is rising, even when delinquency rates remain relatively stable.

- Compliance expectations now extend into servicing, requiring consistent execution, documentation, and audit trails.

- Internal teams are being asked to absorb more volume without proportional headcount growth.

As a result, lenders are turning to outsourced servicing and managed operations not just to reduce cost, but to stabilize performance during volume fluctuations and operational strain.

What this trend signals for lenders:

Outsourcing isn’t just about handling overflow, but about protecting margins and maintaining execution quality at scale. Lenders that integrate managed services into their operating model gain flexibility during demand spikes, reduce fixed labor costs, and maintain consistent borrower treatment across portfolios. Those that rely solely on in-house capacity risk service bottlenecks, rising cost-to-serve, and inconsistent outcomes as complexity grows.

What These Auto Lending Market Trends 2025-2026 Mean for Lenders

The auto lending market trends 2025-2026 point to a clear shift: success isn’t driven solely by origination growth, but by how efficiently risk, servicing, and compliance are managed across the full loan lifecycle.

Lenders that adapt by modernizing technology, tightening structural risk controls, and scaling operations intelligently will be better positioned to protect margins and sustain growth. Those that rely on fragmented systems or static operating models will feel cost and risk pressure earlier, even in stable credit conditions.

defi SOLUTIONS helps lenders respond to these market trends with configurable technology and managed services built for scale. From origination and risk management to servicing and compliance execution, defi enables lenders to operate efficiently, adapt quickly, and grow confidently as market conditions continue to evolve.