In the past, in-house processing was the default strategy for managing auto loan servicing. But the modern lending environment demands a leaner, more adaptive approach.

Outsourcing auto loan servicing offers a scalable way to reduce overhead, streamline after-funding workflows, and improve the borrower experience. It’s a model that works for lenders of all sizes, including community banks, credit unions, and national finance companies.

This article explains how auto loan outsourcing can be cost-effective, where it creates the most value, and how to pick the right outsourcing partner to future-proof your operations.

How Auto Loan Outsourcing Can Be Cost-Effective

Understanding how auto loan outsourcing can be cost-effective is easiest when provided with a direct quantitative and qualitative comparison between outsourced loan servicing and an average in-house team.

Here’s how in-house servicing stacks up against modern outsourced solutions:

| Category | In-House Servicing | Outsourced Servicing |

|---|---|---|

| Labor & Overhead | Expenses like salaries, benefits, training, and turnover costs remain constant regardless of volume. | Variable staffing provided by partner firms, letting lenders scale without adding headcount. |

| Technology & Infrastructure | Ongoing responsibility for maintaining legacy systems, applying patches, ensuring security, and funding new hardware/software. | Providers absorb infrastructure costs, handle updates, and maintain redundancy and cybersecurity safeguards. |

| Scalability | Expanding or contracting requires lengthy hiring or downsizing cycles that add expense and disrupt operations. | Flexible, pay-as-you-scale pricing supports quick adjustment to loan volume fluctuations. |

| Compliance Risk | Internal teams must monitor every rule change; missteps in processes or staff training can trigger penalties. | Shared responsibility with the provider, who builds compliance checks, audit trails, and automation into workflows. |

| Operational Speed | Manual handoffs slow down servicing, from payment posting to account resolution, creating bottlenecks. | Automated workflows and dedicated teams accelerate the resolution of customer issues and account closures. |

The financial contrast between in-house and outsourced servicing is stark. In-house teams carry fixed expenses for salaries, benefits, training, and IT upkeep, even when loan volumes fall.

Take labor, for example. A Texas auto loan company managing lending in-house requires a full team consisting of :

| Role | Annual Salary (Base) | Fully Loaded Cost (~1.30x) | Running Total |

|---|---|---|---|

| Servicing Manager | $65,188 | $84,744.40 | $84,744.40 |

| Customer Service Rep | $43,460 | $56,498.00 | $141,242.40 |

| Collections Specialist | $41,595 | $54,073.50 | $195,315.90 |

| Title Clerk | $38,817 | $50,462.10 | $245,778.00 |

By comparison, most outsourced auto lenders operate on a contract basis with prices typically ranging from 17–40% less than what you’d be likely to pay for an in-house team. More to the point, outsourced auto loan solutions also allow you to scale at a moment’s notice, handling surges in demand without having to take on additional overhead every time you have to add a new employee.

Why More Lenders Are Outsourcing Auto Loan Servicing in 2025

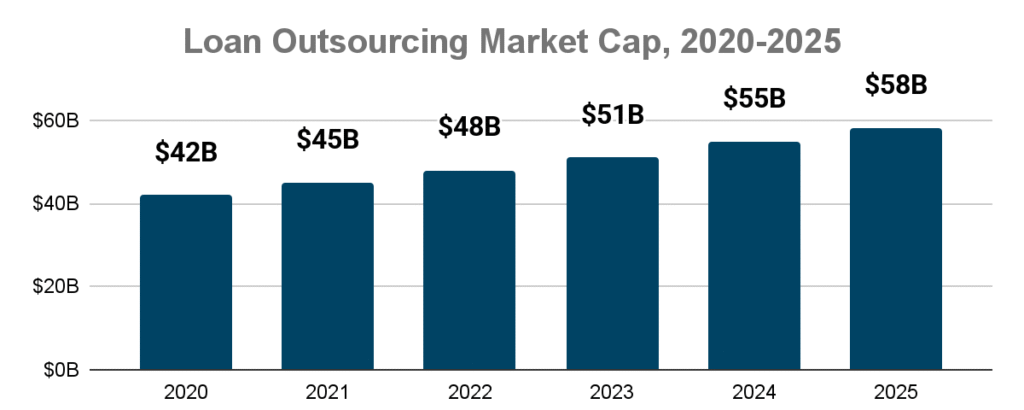

Outsourcing helps lenders offload routine servicing tasks, like payment processing and customer support, onto specialized teams that can deliver faster, more consistent results. With rising loan delinquencies and growing regulatory scrutiny, having a partner built to scale and stay compliant has become necessary.

Source 1 | Source 2 | Source 3

Several data points highlight why more lenders are making the shift:

- Repossession volume is surging. In Q2 2025 alone, lenders assigned 2.42 million unique repossession cases, up more than 20% year over year.

- Servicing costs are rising. The global loan servicing software market is projected to grow from $3.28 billion in 2024 to $8.32 billion by 2033 as modernization accelerates.

- AI and automation are reshaping borrower interactions. Lenders increasingly rely on outsourced partners with intelligent virtual assistants, chat tools, and omnichannel communication platforms.

- Outsourcing now spans the entire loan lifecycle. Providers offer more than just collections, including lease maturity management, title release, remarketing, and default servicing.

Whether lenders need full-service support or targeted help in specific areas, outsourcing offers a scalable and predictable way to streamline operations while enhancing borrower experiences.

What Lenders Gain from Modern Auto Loan Servicing Partners

The value of outsourcing isn’t just financial; it’s also gaining the scale, sophistication, and resilience needed to thrive in a more complex lending environment. Here’s what today’s lenders achieve when they work with specialized servicing partners:

Greater Operational Efficiency

Outsourcing providers bring industrial-grade automation and centralized workflow systems that most in-house operations struggle to match. Payment posting, escrow handling, and document processing move quickly via digital systems with fewer manual touchpoints. AI-enabled contact centers triage routine borrower inquiries in seconds, cutting wait times while allowing human agents to focus on complex or sensitive cases. The result is faster turnaround across the servicing lifecycle with fewer bottlenecks.

Predictable, Scalable Cost Structure

Instead of riding the ups and downs of fluctuating loan volumes and unpredictable staffing costs, outsourcing creates a steady, consumption-based model. Providers let lenders scale resources up during peak periods or new product launches, then scale back when demand slows. Predictable monthly fees give CFOs and operations leaders greater budget control and visibility.

Built-In Compliance Support

As regulatory demands around disclosure, fair servicing, and consumer protection grow, leading outsourcing partners embed compliance automation directly into their workflows. Templates, disclosures, and reports are automatically updated to reflect federal and state rules (e.g.,Truth in Lending Act, Servicemembers Civil Relief Act). These built-in safeguards reduce the chance of costly penalties and give lenders access to audit-ready records at any time.

Better Borrower Experience

Modern providers approach servicing with the borrower at the center. Digital self-service portals, proactive text and email alerts, and multilingual support create a frictionless experience across demographics. Borrowers can check balances, adjust payments, or request payoff quotes without waiting on hold, while call center teams handle exceptions with consistency and empathy. This convenience translates directly into higher borrower satisfaction, loyalty, and retention.

Strategic Focus for Internal Teams

By outsourcing routine servicing functions, lenders free their internal team to work on growth-oriented initiatives. Product teams can focus on new lending products, marketing can build stronger dealer or OEM partnerships, and risk teams can refine credit policy. Outsourcing removes the distractions of day-to-day administration, allowing leaders to redirect resources toward innovation, competitive positioning, and customer acquisition.

Key Criteria for Selecting a Servicing Partner

Not all outsourcing providers are created equal. The right partner can reduce cost-to-serve, strengthen compliance, and improve borrower satisfaction, but the wrong one can introduce risk and inefficiency. To make a smart choice in 2025, lenders should evaluate servicing partners against a clear set of standards that go beyond price.

- Digital Readiness: Look for providers with AI-powered support, borrower self-service portals, cloud-native systems, and real-time dashboards. Legacy tech won’t cut it in a high-volume, high-compliance environment.

- Compliance Alignment: Ensure the partner stays current with auto finance regulations like the Truth in Lending Act, Reg Z, and state-specific repossession rules. Built-in rule engines and audit-ready reporting can drastically reduce risk.

- Customizable Engagement: Choose providers that offer both loan origination, end-to-end servicing, and à la carte options. You should be able to outsource what you need, whether that’s lease maturity handling, customer communications, or backup servicing.

- Scalability and SLAs: Ask about uptime guarantees, servicing capacity, and how they handle seasonal or unexpected loan volume spikes. A good partner should flex with your business.

- Borrower-Centric Approach: Great servicing partners improve NPS, reduce complaints, and streamline communication. Look for conversational AI, multichannel communication, and borrower transparency as part of the offering.

Together, these criteria give lenders a clear framework for evaluating the right servicing partner, one that balances cost efficiency with compliance and borrower satisfaction.

Experience the defi SOLUTIONS Servicing Advantage

defi SOLUTIONS empowers lenders to simplify operations without sacrificing quality or compliance. By partnering with us, lenders gain a clear example of how auto loan outsourcing can be cost-effective.

From lease maturity support to borrower communications, our platform delivers speed, scale, and digital-first service backed by intelligent automation and purpose-built workflows. Whether you’re looking to reduce costs or improve customer satisfaction, defi offers the flexibility and control your team needs to grow with confidence.

For more information on how defi SOLUTIONS can help you streamline auto loan servicing while meeting today’s operational and compliance demands, book a demo with us.

Getting Started

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. With defi ORIGINATIONS, lenders can increase revenue and productivity through automation, configuration, and integrations, and incorporate data and services that meet unique needs. For more information on outsourcing auto loan servicing, contact our team today and learn how our cloud-based loan origination products can transform your business.