Managing large scale auto lending and servicing requires a level of coordination, compliance rigor, and operational efficiency that legacy systems simply weren’t built to support. With higher loan volumes, broader dealer networks, and growing regulatory oversight, enterprise lenders need platforms that can connect every department and every stage of the loan life cycle.

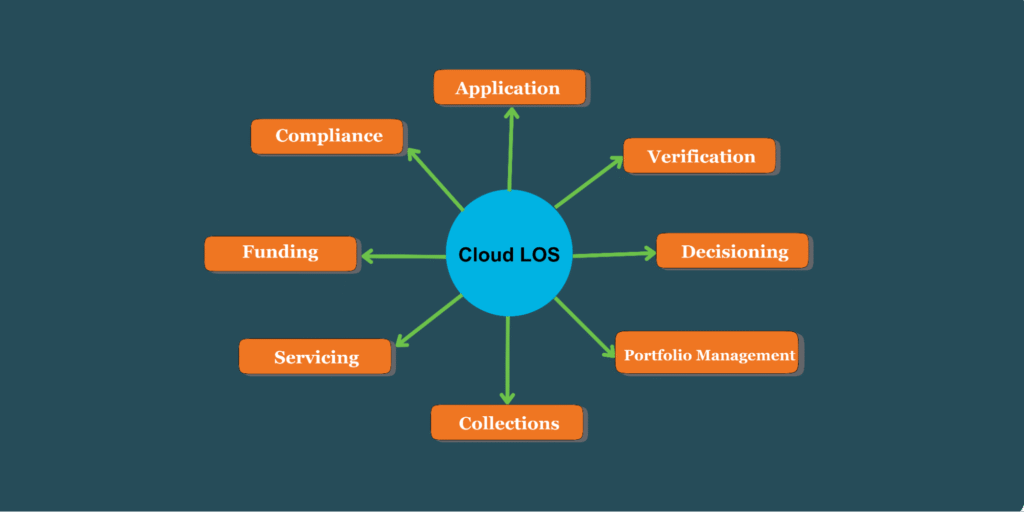

Modern cloud-based infrastructure makes that possible. It unifies origination, underwriting, funding, servicing, collections, and compliance into one connected ecosystem. The result is clearer visibility, stronger automation, and nationwide scalability.

Why Cloud-Based Infrastructure Matters at Scale

Cloud-based lending and servicing systems allow lenders to unify operations across teams, locations, and departments. For large institutions, this brings structural advantages:

| At-a-Glance: Why Cloud Infrastructure Matters at Scale | ||

|---|---|---|

| Benefit Area | Core Function | Lender Advantage |

| Enterprise scalability | Absorb volume spikes | No slowdowns in peak cycles |

| Unified workflows | Connect all departments | Instant updates across teams |

| Compliance alignment | Automate rules & audits | Fewer errors, stronger oversight |

| Lower total costs | Remove hardware & upkeep | Reduced IT spend long-term |

| Faster innovation | Add tools & programs | Quicker market adaptation |

- Enterprise-level scalability: Large lenders must absorb major volume spikes during seasonal buying cycles, new dealer onboarding waves, promotional events, or regional surges. Cloud-based lending infrastructure makes this possible by dynamically scaling capacity without adding hardware or straining internal teams.

- Seamless multi-department connectivity: Origination, underwriting, funding, servicing, collections, recovery, and compliance all operate within a single system and shared data environment. A change made in underwriting (e.g., updated LTV rules) is instantly updated everywhere, eliminating cross-departmental silos that cause delays and rework.

- Continuous compliance alignment: Automated rule engines, real-time audit logs, permission controls, and workflow tracking help large lenders maintain compliance with state and federal regulations. Every change made in policy or underwriting logic is applied globally, reducing inconsistencies and eliminating manual oversight gaps.

- Lower total cost of ownership: Cloud infrastructure removes the need for physical servers, on-premise maintenance, and expensive upgrade cycles. IT workloads shrink significantly, and updates roll out instantly, freeing lenders from multi-year deployment delays and the ongoing cost of supporting legacy hardware.

- Faster innovation: Lenders can introduce new lending programs, expand into additional regions, or integrate verification and fraud-detection tools without re-engineering their tech stack. Cloud architecture supports rapid iteration, enabling lenders to adapt quickly as market conditions, risk patterns, and borrower expectations evolve.

Large scale lenders simply cannot achieve these benefits with an on-premise or fractured system environment.

Connecting Every Step of the Loan Lifecycle

A core advantage of modern cloud systems is the ability to hold the entire lending and servicing lifecycle on one platform:

This full connection produces several measurable benefits:

- Fasten loan processing time by up to 50%

- Fewer handoffs between departments

- Consistent data across teams

- Improved audit trails and compliance readiness

- Better service levels for borrowers and dealers

For lenders operating across dozens or hundreds of branches, or across the country, this ecosystem eliminates the operational drag of disconnected legacy tools.

Mitigating Risk and Maintaining Compliance at Scale

For large lenders, risk spreads quickly. Cloud-based platforms create consistency across the entire organization:

| Risk & Compliance at a Glance | ||

|---|---|---|

| Focus Area | Key Challenge | Lender Advantage |

| Automated Decisioning | Inconsistent policy use | Same rules applied everywhere |

| Documentation Control | Disorganized files & gaps | Audit-ready digital trails |

| Enterprise Reporting | Limited portfolio visibility | Real-time risk insights |

| Fraud Screening | Missed red flags | Faster detection |

| Policy Alignment | Slow policy rollouts | Updates apply system-wide |

- Automated credit decisioning: Rules-based engines apply policy the same way across every channel, every dealer, every underwriter.

- Uniform documentation & audit readiness: Document storage, timestamps, and digital trails simplify regulatory exams and internal audits.

- Enterprise reporting: Portfolio-wide insights give risk teams a real-time view of performance, exceptions, and early indicators.

- Fraud detection: Integrations with identity, income, and fraud data providers allow rapid detection of misrepresentation or high-risk applications.

- Policy alignment: When policy terms, income rules, and state-specific regulations change, they are updated once and applied consistently across all relevant areas.

This level of control is essential for large lenders with multi-state operations and large servicing populations.

Time & Cost Savings: What Large Lenders See After Modernization

When large lenders move to a cloud-connected environment, the impact is significant:

| At-a-Glance: Time & Cost Savings for Large Lenders | ||

|---|---|---|

| Benefit Area | What Improves | Lender Advantage |

| Underwriting Efficiency | Cuts time spent on tasks by 30-40% | Faster decisions, lower labor costs |

| Decisioning Speed | Hours → minutes (~ 90% faster) | More deals, happier dealers |

| Loan-to-Funding Time | Shorter cycle times | Faster revenue recognition |

| Servicing Accuracy | Fewer servicing errors | Lower rework and disputes |

| Cost-to-Serve | 35% infrastructure cost reduction | Major savings at scale |

| Compliance Control | Standardized workflows | Fewer audit exceptions |

| Call Center Load | Fewer borrower inquiries | Higher service efficiency |

| Dealer Satisfaction | Consistent turnaround times | Stronger dealer retention |

- Automation eliminates repetitive underwriting tasks, enabling teams to focus on high-value reviews instead of clerical checks.

- Cloud workflows accelerate verification and funding, helping large lenders respond in hours instead of days.

- Centralized systems reduce the cost-to-serve, minimizing exceptions, rework, and IT maintenance associated with legacy tools.

- Servicing teams see fewer errors, smoother call handling, and improved consistency across branches and regions.

- Compliance teams gain stronger visibility, with standardized rules, audit trails, and uniform documentation across states.

These improvements allow lenders to scale volume without proportional increases in staffing or infrastructure.

How Large Scale Auto Lending and Servicing Works On The Ground

Large lenders consistently need scale, speed, configurability, and a partner capable of handling enterprise complexity.

Based on those implementations, look for a partner that offers:

- Configurable Workflows Designed for Scale: Allows lenders to tailor decision rules, stipulate logic, verify paths, fund steps, and service processes, without waiting on IT backlogs.

- Deep Integration Ecosystem: Connects workflows to credit bureaus, fraud solutions, verification partners, dealer platforms, document systems, and more, all inside one unified environment.

- Proven Enterprise Onboarding: National-level deployments often require:

- Migration from multiple legacy systems

- Integration across LOS, LMS, and outsourced servicing partners

- Compliance alignment for multi-state portfolios

- Cross-team testing and rollout across distributed operations

- Support for High-Volume Operations: Includes cloud infrastructure that is engineered for lenders processing thousands of daily applications or managing large servicing populations across the U.S.

- Dedicated Implementation & Customer Success: Receives hands-on deployment teams, configuration specialists, and long-term strategic support to ensure the system evolves with their business.

A Cloud-Ready Future for Large Scale Auto Lending and Servicing

Large scale auto lending and servicing require speed, accuracy, and seamless coordination across the entire loan lifecycle. Cloud-based platforms provide lenders with the technology foundation necessary to reduce operational friction, strengthen compliance, manage risk, and scale efficiently across regions and dealer networks.

With defi SOLUTIONS, large lenders gain a connected, configurable, and proven platform designed to support high-volume origination and servicing from end to end. Book a demo with us today to explore how cloud automation can simplify lending at scale.

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. For more information on large scale auto lending and servicing, Contact our team today and learn how our cloud-based loan origination products can transform your business.