Auto finance is changing faster than your approval algorithms can keep up. New tech, new risk, new expectations. Whether you’re a lender, a captive, or a fintech newcomer, staying competitive now means mastering AI-powered decisioning, adapting to EV market shifts, and streamlining originations from click to funding.

This article covers five critical auto finance industry trends poised to reshape how lenders compete, originate, and grow in 2026 and beyond.

Trend 1: AI-Powered Credit Scoring and Decisioning

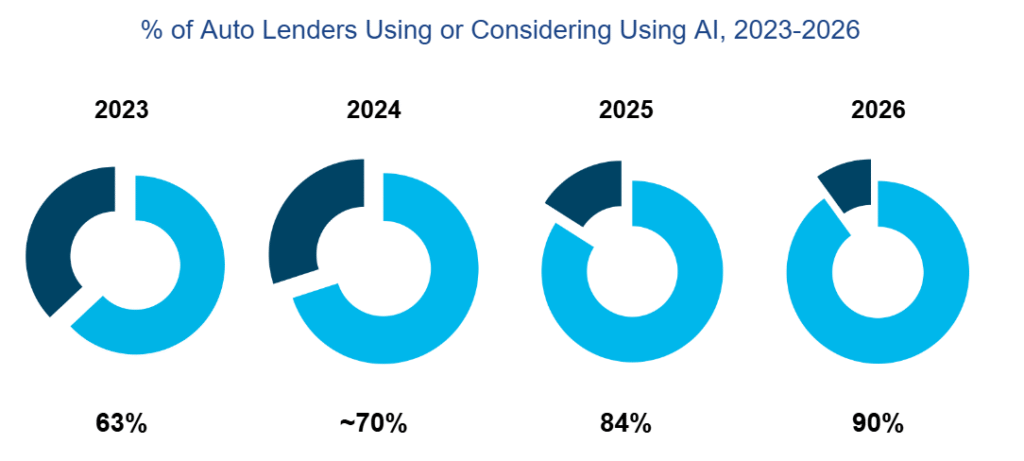

Legacy credit models weren’t built for today’s borrowers or today’s risk landscape. That’s why more auto lenders are turning to AI-powered credit scoring to deliver faster, more accurate, and more inclusive decisions.

Source 1 | Source 2 | Source 3

Traditional scoring methods rely heavily on rigid thresholds and backward-looking data. In contrast, AI models analyze a broader variable range, including spending behavior, banking patterns, employment history, and alternative credit signals. This enables lenders to score thin-file applicants more effectively, surface qualified borrowers that FICO might overlook, and quickly adapt to shifting market conditions.

| Traditional vs AI-Powered Credit Scoring Inputs | ||

|---|---|---|

| Category | Legacy Credit Models | AI-Powered Credit Models |

| Credit History | FICO score, delinquencies, and credit length | FICO + behavioral trends over time |

| Income Data | W-2 income, debt-to-income (DTI) ratio | Bank transaction patterns, cash flow analysis |

| Employment | Current employer, tenure | Employment volatility, job-switching patterns |

| Alternative Credit Signals | Rarely considered | Rental payments, utility bills, subscription payments |

| Decision Logic | Static scorecards, if/then rules | Dynamic ML-based models that learn and adapt |

| Risk Adjustment | Manual overlays, limited segmentation | Real-time adjustments based on macro and borrower-level data |

| Speed | Hours to days | Seconds |

| Explainability | Minimal; opaque scoring logic | Explainable AI (XAI) for regulatory transparency |

The payoff includes:

- Higher approval rates among nonprime and near-prime segments

- Faster decisions without compromising risk management

- Lower default rates through more granular credit analysis.

Along with accelerating underwriting, AI decisioning tools also improve outcomes. In a case study by Uplinq and Visa, lenders using AI-powered credit assessment saw a 50% reduction in underwriting costs, a 15-times drop in credit losses, and a 3-times boost in line-of-business profitability.

Unlike static scorecards that degrade over time, modern AI models learn and improve with each new data point. And when embedded directly into the loan origination system, they reduce borrower friction while enforcing policy-aligned, compliant decisions in real time.

Looking Ahead: Smarter Lending Starts Here

As borrower expectations shift toward faster and fairer access to financing, and as regulators push for greater transparency in decision-making, lenders will need intelligent systems that are also explainable and audit-ready.

In 2026 and beyond, lenders should expect:

- Wider adoption of explainable AI (XAI) frameworks that reveal how and why decisions are made

- Expanded use of alternative data, such as rent payments, utility bills, or bank activity, to broaden access

- Dynamic, real-time decision routing, where AI selects the optimal product, pricing, and servicing path based on borrower profile and intent.

Trend 2: EV Financing Becomes a Volume Driver

Electric vehicles are an anchor of new loan volume. But financing an EV isn’t the same as financing a gas-powered car, and lenders who treat them the same risk leaving business (and margin) on the table.

Many buyers are still drawn to EVs thanks to unique price points, different depreciation curves, and borrower incentives. However, several of the most popular federal tax credits introduced under the Inflation Reduction Act have now expired following the July 2025 reconciliation package. For example, the $7,500 federal tax credit for new EVs and $4,000 for used EVs officially sunset on September 30, 2025, unless the vehicle was already under contract. That makes it more important than ever for lenders to monitor evolving state incentives, OEM financing programs, and deferred payment options to maintain affordability, particularly for borrowers who are affordability-conscious. Lenders should stay current on these shifting incentives to structure more attractive, accessible EV loan offers.

Meanwhile, the average EV transaction price remains over $57,000, according to Kelley Blue Book. That means more borrowers are taking out larger, longer-term loans, often with lower down payments. Without proper tools to assess LTV, depreciation risk, and incentive eligibility, lenders could be exposing themselves to unnecessary risk or rejecting otherwise healthy applications.

To avoid these pitfalls and fully capture EV demand, lenders should assess their current capabilities across key readiness areas:

| EV Financing Readiness Checklist for Lenders | ||

|---|---|---|

| Readiness Area | Questions to Ask | Why It Matters |

| Loan Product Fit | Do you offer EV-specific loan or lease products? | EVs often require longer terms, lower upfront payments, or deferred structures. |

| Incentive Handling | Can your LOS adapt to state-loan incentives or OEM programs in real time? | Federal tax credits have phased out; localized incentives now play a bigger role.. |

| Risk Modeling | Does your underwriting account for EV depreciation, battery life, or resale value? | EVs follow different value curves and carry unique risks. |

| OEM Partnerships | Are you integrated with OEMs or EV dealerships? | Enables bundled offers, quicker closings, and better borrower experience. |

| EV Data Access | Can you use telematics or usage data to inform pricing or servicing? | Useful for fleet loans, accurate residuals, and flexible pricing models. |

Smart lenders are adjusting by:

- Offering EV-specific loan products and rate structures

- Using configurable structuring tools to instantly adjust terms around incentive timing

- Tapping OEM partnerships to create better bundled offers at the point of sale.

Looking Ahead: EV Lending Moves Into the Mainstream

In 2026 and beyond, lenders who fail to modernize their EV financing approach may find themselves outpaced, not just by OEM captives but by digital-first lenders with more flexible infrastructure. Expect to see:

- More leasing options, especially for fleet and subscription models

- Residual value modeling powered by real-world usage data and telematics

- Expanded risk models that account for charging infrastructure, battery life, and secondary market liquidity

- Greater demand for integrated incentives tools inside the LOS, enabling lenders to validate rebates and credits in real time.

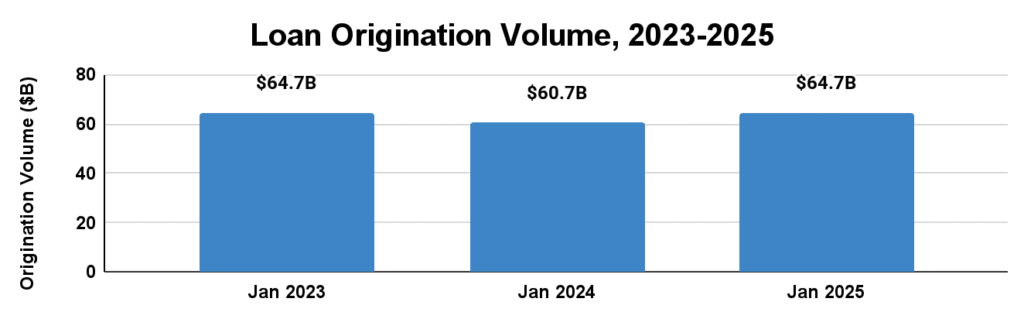

Trend 3: Auto Loan Origination Volumes Rebound, With Diverging Strength

After periods of volatility driven by inflation, supply chain issues, and rising rates, auto loan originations are showing clear signs of recovery. Large banks, in particular, are seeing substantial growth in Q2 2025, a trend that’s reshaping who leads the market. For example:

- Ally Financial grew originations 12.2% year-over-year to $11 billion

- Chase Auto saw a 4.6% YoY rise to $11.3 billion

- Wells Fargo reported a dramatic 86.5% YoY jump to $6.9 billion.

At the national level, seasonally adjusted loan origination volumes in January 2025 matched January 2023 levels, reversing the dip seen in early 2024.

Regional lenders, however, are not seeing uniform gains: some are growing originations, while others are facing declines.

What’s driving the rebound:

- Purchases pulled forward by consumers anticipating higher costs or tariffs

- Lease volume increases alongside loan originations

- Better credit performance in some segments, easing underwriting constraints.

Smart lenders are responding by overhauling origination workflows, improving speed, flexibility, and digital engagement to seize growth.

Looking Ahead: Origination Becomes a Growth Lever

In the years ahead, lenders that treat origination as a growth lever, not just a workflow, will be better positioned to win market share. Expect to see:

- More lenders targeting digital channels and embedded finance to capture emerging demand

- Increased interest in automating repetitive underwriting and adopting express contract tools

- Greater investment in origination analytics, including real-time dashboards tracking approval-to-book, abandonments, and funding velocity.

Trend 4: Delinquency Management Becomes a Risk Differentiator

Delinquencies are a core risk management challenge that directly impacts lender profitability and investor confidence.

As auto loan balances remain elevated and household budgets tighten, more borrowers are starting to miss payments. According to a LendingTree study, 5.1% of Americans with an auto loan are delinquent in at least one account; this is predominantly prevalent among borrowers in southern states.

In this environment, leading lenders are investing in proactive delinquency management strategies to identify risk earlier and respond faster. What sets them apart?

- Real-time account monitoring that tracks risk signals like payment behavior shifts, location pings, and insurance lapses

- AI-driven segmentation to tailor outreach strategies by borrower risk profile and communication preferences

- Omnichannel contact (SMS, email, in-app, phone) that escalates intelligently based on borrower activity

- Loan modification automation that tests deferments, term extensions, or partial payments within policy limits.

| Reactive vs. Proactive Delinquency Management | ||

|---|---|---|

| Category | Reactive Approach (Legacy Systems) | Proactive Approach (Modern Lenders) |

| Risk Detection | Delinquency is identified after missed payments (30–60 days) | AI/ML models flag high-risk accounts before a missed payment |

| Communication | Manual outbound calls and letters | Automated, omnichannel outreach (SMS, email, phone, in-app), personalized to borrower preferences |

| Response Speed | Case-by-case escalation; often too late to recover | Real-time response to early signals (payment behavior, geolocation, insurance lapse) |

| Loan Modification | Manual review and approval process | Automated, in-policy loan modification options (deferment, term extension, partial payments) |

| Borrower Segmentation | Basic risk tiers (prime vs. subprime) | Dynamic risk profiling using behavior, location, account history, and repayment signals |

| Insights Integration | Siloed from origination or servicing data | End-to-end visibility—servicing insights inform future underwriting and retention strategies |

Reducing the number of accounts that move from early-stage delinquency into charge-off territory enables lenders to protect their portfolios, improve borrower retention, maintain liquidity, and reduce servicing costs.

Looking Ahead: Risk Becomes Personal, and Predictive

The next frontier in delinquency management will be about anticipating risk before it materializes. As borrower behavior grows more complex and financial strain surfaces in subtle, early-stage signals, lenders will need to shift from reactive collections to predictive, personalized strategies.

In 2026, expect top lenders to:

- Use machine learning models that predict delinquency before it happens

- Offer pre-delinquency nudges based on behavioral cues and usage data

- Implement borrower-level scoring for payment flexibility offers

- Integrate servicing tools with origination insights to flag hidden risk trends.

Trend 5: Embedded Auto Finance Extends Beyond the Dealership

Today’s consumers expect financing options to appear wherever they shop for vehicles, from online marketplaces and OEM apps to ride-hailing platforms and EV subscription services.

This is the rise of embedded auto finance: pre-approved, contextual offers that appear at the point of interest, not just the point of sale. This model, borrowed from fintech, is now reshaping how loans are marketed, structured, and delivered.

Forward-looking lenders are embedding their loan offerings into:

- Digital car retail platforms (Carvana, Shift, OEM sites)

- Mobile dealer apps that pre-qualify users browsing inventory

- EV and mobility platforms offering flexible leasing or subscriptions

- Partner ecosystems like insurance, warranty, or maintenance apps.

These integrations demand real-time credit decisioning, automated structuring, and instant document generation to make embedded financing seamless.

| Dealership vs. Embedded Auto Finance: What’s Changing | ||

|---|---|---|

| Feature | Traditional Dealership Financing | Embedded Auto Finance |

| Where Financing Happens | In-person at the dealership | Online, in apps, digital marketplaces |

| When Offers Appear | After the buyer selects a vehicle | At the point of interest, while browsing or comparing |

| Approval Timing | Hours or the next day | Real-time or near-instant |

| Application Process | Manual paperwork, often sales-led | Pre-filled, self-service, digitally streamlined |

| Partner Ecosystem | Limited to dealership lender network | Expands to OEMs, EV apps, insurance, and mobility |

| Reach | Walk-in customers only | Digital-first buyers who may never visit a dealership lot |

For lenders, the payoff is significant: increased application volume, faster cycle times, and higher conversion rates, often from non-traditional borrowers who would never walk into a dealership but are happy to transact online.

Looking Ahead: Lending Goes Where the Buyer Is

As digital retail, EV adoption, and flexible mobility options reshape the customer journey, embedded lending will become a strategic differentiator. Lenders that want to stay competitive will need to deliver financing not just at the point of sale, but when and where the borrower is most engaged.

In 2026 and beyond, embedded auto finance will:

- Expand into EV charging platforms, car-sharing apps, and even OEM infotainment systems

- Use AI personalization to match the right offer to the right shopper in real time

- Enable one-click financing with pre-filled applications and identity verification

- Rely on modular lending infrastructure to adapt offers based on usage, geography, or partner platform.

Auto Finance Industry Trends: Navigating What’s Next

Whether you’re a captive, bank, or independent lender, staying ahead means investing in the technologies and partnerships that make your lending process faster, more flexible, and more intelligent.

In 2026, the winners won’t be the ones with the lowest rate; they’ll be the ones who deliver the best experience for every kind of borrower, anytime, anywhere.

See how defi SOLUTIONS can help you automate, scale, and modernize your loan process.

Book a demo today and put tomorrow’s tools to work for today’s market.

Getting Started

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. For more information on auto finance industry trends, Contact our team today and learn how our cloud-based loan origination products can transform your business.