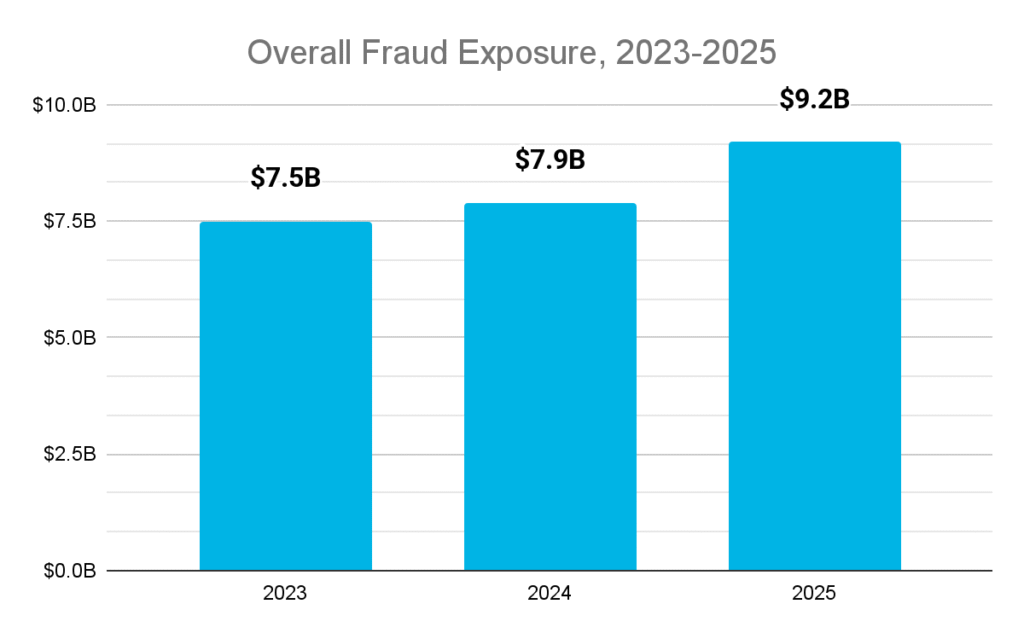

According to a recent Point Predictive report, fraud exposure in 2025 is estimated to be larger this year than it has in the last five years:

In short, fraud is becoming more pervasive in the lending sphere than it has been in the last several years, as well as more diverse. This makes it all the more important to have robust loan application fraud detection best practices in place. The table below presents the top eight loan application fraud detection best practices.

|

Practice |

Fraud Stage |

Fraud Type Targeted |

Estimated Fraud Reduction? |

Implementation Difficulty |

|

|---|---|---|---|---|---|

|

1 |

Automated Detection & Analysis |

All |

All |

40-60% |

Low |

|

2 |

Data Verification |

Pre-loan |

Stolen identity, first-party |

25-35% |

Medium |

|

3 |

Credit History Analysis |

Pre-loan |

Credit washing |

15-20% |

Low |

|

4 |

Employee Training |

Pre-loan |

5-10% |

Low |

|

|

5 |

Collaboration and Information Sharing |

Pre-loan |

Repeat offenders, credit washing |

20-30% |

Medium |

|

6 |

Behavioral Biometrics |

Application |

Bots, Spoofing |

25-40% |

High |

|

7 |

Document Authentication |

In-process |

Forged IDs/Docs |

30-40% |

Medium |

|

8 |

Regular Audits and Monitoring |

Post-Approval |

All |

10-15% |

Medium |

The following sections detail each of the entries on the table above:

Automated Fraud Analytics and Detection

Automated detection is, by far, the most comprehensive and easily implemented fraud detection best practice on this list. These tools provide automated pattern/anomaly detection when evaluating applications, as well as automated decisioning rules to flag and investigate potentially fraudulent applications.

AI-powered solutions have become increasingly popular within the last decade, but the most recent iteration uses privacy-preserving or explainable systems, which are becoming more necessary to ensure compliance.

| Best Practices |

| Ensure that your loan origination system provides XAI and/or federated models to meet regulatory standards. It’s perfectly fine if these models are available via integration or native |

Data Verification

Being able to evaluate the authenticity of applications as they come in is an essential step in your security stack. Some of the standard methods used for this purpose include:

- Multi-factor authentication

- Biometric verification (especially useful for mobile users, which are growing in number every year)

- Document verification

Identity verification capabilities are often included in loan origination software. These can verify documents (e.g., government-issued IDs, passports, and utility bills) for consistency and accuracy, but they can also flag inconsistencies, errors, or discrepancies where they appear.

| Best Practices |

| Verify addresses through reliable sources, cross-check with utility bills/government records. Check employment information through direct contact or third-party services |

Credit History Analysis

To assess applicants’ creditworthiness, the software analyzes their credit history. An unusual pattern, sudden change, or discrepancy in credit history can indicate fraud. Working through your loan origination system allows you to:

- Check credit reports for inconsistencies and suspicious activities

- Monitor for changes in credit history (e.g., rapid increase in inquiries, newly opened accounts, significant changes in credit scores)

- Use alternative credit data sources to identify risky behavior.

Having tools in place to carefully evaluate an individual’s credit history allows lenders to reduce instances of synthetic identity theft, in which entirely new identities are fabricated using existing stolen data.

| Best Practices |

| Combine bureau and non-bureau data via a centralized analytics dashboard |

Document Authentication

According to Point Predictive’s 2025 report, forged documentation—particularly related to income and employment—plays a role in more than 40% of all auto lending fraud, contributing to $3.9 billion in exposure. Among a variety of points, the process consists of checking:

- Format/template validation

- Metadata & file integrity analysis

- Image analysis to spot unusual cropping or layering

- Reused signatures/seals

Using your loan origination system to identify these patterns is a great first step, but often the nuances of this process similarly require a human touch, requiring specialized employee training, as discussed in the next step.

| Best Practices |

| Implement document authentication solutions to verify the legitimacy of identity documentsUse OCR technology to check for alterations or inconsistencies in scanned documentsImplement a layered verification process that includes automated and human review |

Employee Training

The last line of defense in your loan origination system is the human element. Employees need to be able to recognize potential signs of fraud during the application process (e.g., inconsistent information, suspicious documents, multiple applications). It’s critical that lending institutions foster a culture of vigilance and encourage employees to report suspicious activities.

| Best Practices |

| Hold regular employee reviews and quarterly training to ensure that employees are up to date on the latest practices. Implement workflows for reporting fraud |

Collaboration and Information Sharing

Loan origination software often integrates with databases containing information about known fraudsters, which helps prevent loans from being granted to individuals or organizations with a history of fraudulent activities.

Especially important to consider is the recent development of fraud toolkits sold on dark web marketplaces, which provide attackers with easy access to real borrower data to conduct attacks.

| Best Practices |

| Collaborate with other financial institutions and share information on known fraud casesUse fraud databases and consortiums to identify suspicious patterns or individualsLeverage verification services to confirm or refute claims made on loan applications |

Behavioral Biometrics

Traditional biometrics focuses on keystroke dynamics, mouse movement patterns, and continuous monitoring to authenticate the identity of the user. More modern solutions that have become increasingly common in the last five years include:

- Standardized device fingerprinting

- IP velocity checks

- Proxy/VPN detection

These security measures focus primarily on automated forms of fraud, such as the use of bots or spoofing, by providing automated security checks designed to require human input. In particular, modern loan origination systems often have measures in place to detect changes in behavior during the application process.

| Best Practices |

| Integrate loan origination system with analytics programs for continuous monitoring |

Regular Audits and Monitoring

It’s important to remember that the field is always moving; loan application fraud detection in 2025 requires practices that weren’t even thought of 10 years ago, and that process will continue to evolve. That means refining your process even as you perfect it.

| Best Practices |

| Schedule regular internal audits and implement alert thresholds in softwareConduct regular audits of loan applications and approvals to identify irregularitiesImplement continuous monitoring systems to detect and respond to fraud in real time |

Emerging Types of Fraud in 2025

2025 is shaping up to be a particularly unique year for loan application fraud. In particular, credit washing—the practice of removing negative but true items from their credit report via claims of identity theft—has nearly tripled since last year, with Q4 2024 data increasing to 1.7%.

The following table outlines this and several other forms of loan application fraud in 2025, as well as the specific loan application fraud detection best practices to address them.

Emerging Fraud Methods, 2025

|

Element |

Status |

Best Practices |

|---|---|---|

|

Credit Washing |

Very High |

Use credit report “persistence” tools Verify claims via third-party databases |

|

Deepfake & Synthetic Identity Detection |

High |

Implement liveness detection, Facial movement tracking |

|

Fraud-as-a-Service (FaaS) |

Widespread |

Monitor the dark web |

|

Real-Time Payment Fraud Considerations |

Emerging |

Pre-transaction scouring Real-time behavioral analytics |

|

Federated Learning & Explainable AI (XAI) |

Emerging |

Federated learning models Explainable AI frameworks (e.g., SHAP, LIME) |

|

Device & Network Intelligence |

Common |

Device fingerprinting IP analysis Proxy detection |

To manage these trends, partnering with the right people is critical; we highly recommend joining industry fraud consortiums (e.g., Point Predictive, Early Warning) as well as having a quality loan origination system in place that integrates with a variety of security measures to improve your automated processes.

Smarter, Faster Lending Starts With defi

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. With defi ORIGINATIONS, lenders can increase revenue and productivity through automation, configuration, and integrations, and incorporate data and services that meet unique needs.

For more information on loan application fraud detection, contact our team today and learn how our cloud-based loan origination products can transform your business.