Electric vehicle (EV) lending is entering its next phase as demand stabilizes and lenders adjust to changing consumer preferences, incentive structures, and residual value uncertainty.

These shifts create opportunity, but also expose lenders who apply assumptions built for conventional internal combustion engine vehicles. EV risk behaves differently, and profitability now depends on lifecycle visibility, instead of simply loan origination accuracy.

This guide outlines the key considerations for lenders evaluating electric vehicle lending management and services in 2026.

| Key EV Lending Readiness Areas: At A Glance | |||

|---|---|---|---|

| Readiness Area | Core Shift | What Changes for Lenders | System Readiness Required |

| EV Volume Growth Moving Into 2026 | EVs reach portfolio scale | EVs handled as standard loans | Scalable, policy-driven workflows |

| EV Values Move Faster and Unevenly | Nonlinear depreciation | Mid-cycle LTV volatility | Dynamic VIN-level valuation |

| EV Turn-In, Inspection, and Settlement Variability | Value tied to condition | Higher payoff scrutiny | EV-specific inspection logic |

| Higher Oversight and Audit Defensibility | More judgment visibility | Exceptions must be traceable | Automated decision logging |

| More Complex Payoff and Customer Expectations | Transparent value comparison | Increased dispute sensitivity | Real-time payoff accuracy |

1. Prepare for EV Volume wth Moving Into 2026

EV financing volume is no longer a fringe phenomenon. Lenders must now support EVs at portfolio scale, rather than treating them as isolated loans reviewed outside standard policy.

What the latest data shows

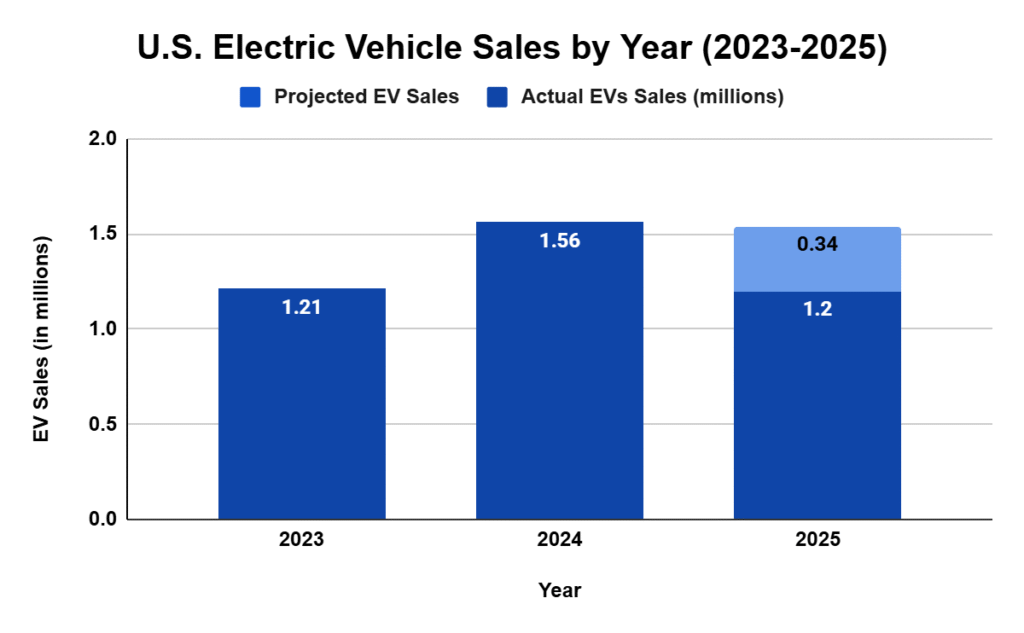

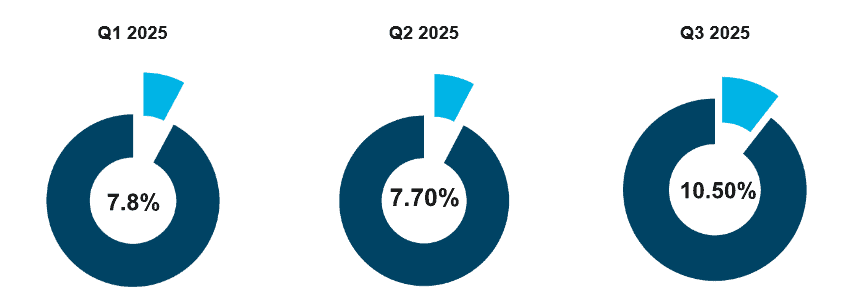

- In the U.S., EV sales exceeded 1.06 million units through Q3 2025, the highest year-to-date total on record. With Q4 sales projected, full-year EV volume is expected to approach 1.4-1.5 million units. This performance comes as incentives are phased out, suggesting EV adoption is increasingly driven by product availability, pricing normalization, and consumer demand rather than policy support alone.

Source 1 | Source 2 | Source 3 | Source 4

- In Q3 alone, EVs represented approximately 10.5–11% of all new vehicle sales.

EVs sales are being driven by a broader lineup of mid-priced EV models, longer battery warranties, increased dealer inventory availability, and steadily improving confidence in used EV resale values. As a result, EV demand is spreading beyond early adopters into mass-market financing segments.

What lenders must prepare now

To support EV sales, lenders need systems that can:

- Track EV-specific valuation trends by model, trim, climate region, and charging access

- Incorporate battery-health data into residual assumptions

- Reevaluate the advance rate bands more frequently

- Apply policy logic dynamically

EV portfolios have completely different depreciation patterns, payoff accuracy requirements, and settlement risk profiles than other vehicles.

2. Prepare for EV Values That Move Faster and More Unevenly Than Other Vehicles

EV collateral values are not depreciating in predictable curves like other vehicles. They fluctuate more rapidly and unevenly, depending on factors such as battery condition, warranty status, regional resale demand, charging access, and technology cycles.

Recent studies reflect how wide the variance can be:

- A five-year analysis found that EVs lost 58.8% of their value over five years, compared with an average depreciation of about 45.6% across the broader vehicle market.

- Industry research also shows segments of used EV inventory are experiencing approximately 32% year-over-year pricing decline, primarily when new model years replace prior variants or incentive structures change.

- In certain studies measuring the total economic cost impact, EV depreciation was estimated at $0.27 per mile, versus roughly $0.11 per mile for other vehicles, highlighting how much faster value can shift when batteries age or range declines.

These data points show uneven EV value movement, not because all EVs decline at the same rate, but because value drops cluster around certain models, regions, and warranty timelines. In many cases, depreciation accelerates mid-cycle rather than gradually, which is fundamentally different from other vehicle portfolios, where value declines are more predictable from year to year.

What lenders must prepare for now

To manage faster and uneven valuation shifts, systems must be able to:

- Surface VIN-level value changes and alert when LTV spikes

- Segment depreciation by region, model year, and battery warranty status

- Align payoff, extension, and refinancing decisions to current (not original) value

- Incorporate valuation updates into pricing and advance thresholds automatically

This matters because EV loans rarely follow linear value curves. When value moves mid-cycle abruptly, manual pricing updates cannot keep pace, and risk compounds quickly. Lenders need dynamic valuation logic and real-time triggers, or loss severity will become apparent at payoff, extension, or liquidation rather than at origination.

3. Prepare for EV-Specific Turn-In, Inspection, and Settlement Variability

End-of-term processing for EVs introduces inspection points and settlement variables that do not exist in conventional vehicles. Standard vehicle turn-ins generally rely on mileage, cosmetic condition, and standard mechanical assessment. EVs require additional evaluation tied directly to economic value.

The EV-specific condition factors lenders must assess

Assessing EV condition at turn-in requires more than identifying risk factors. Lenders need clear benchmarks to distinguish normal wear from value-impacting risk.

| EV Turn-In Condition Benchmarks Lenders Can Use | |||

|---|---|---|---|

| Condition Factor | Typical / Acceptable Range | Signals to Watch Closely | Why It Matters |

| Range degradation vs. EPA rating | ~5–10% decline at mid-life | >15–20% degradation | Directly impacts resale value and buyer confidence |

| Battery warranty coverage | Warranty is active or partially remaining | Warranty expired or is near expiration | Expired coverage increases pricing discounts and dispute risk |

| Battery health diagnostics | OEM-validated or standardized health report | Missing, non-standard, or inconsistent data | Limits valuation accuracy at settlement |

| Charging equipment condition | OEM charger present and functional | Missing, damaged, or aftermarket equipment | Reduces resale appeal and increases reconditioning cost |

| Software version compliance | Up-to-date firmware and recalls addressed | Outdated software or restricted features | Can impair range, functionality, and marketability |

These items directly affect resale value, equity at payoff, and end-of-cycle recovery.

Why EV turn-in gaps creates operational risk

If lenders cannot validate battery-driven value elements at turn-in, three downstream risks emerge:

- Inaccurate settlement causes a chargeback, appeal, or dispute

- Remarketing proceeds fall below the expected residual recovery

- Extensions or refinances occur at an inflated valuation

Additionally, EV customers often monitor online resale estimates and publicly available pricing benchmarks, making discrepancies more visible.

What lenders must prepare now

Systems and workflows should be designed to:

- Embed EV-specific inspection fields and condition scoring

- Validate warranty coverage dates and battery-replacement eligibility

- Collect battery-health metrics digitally at turn-in

- Link inspection outcomes directly to payoff and fee calculation

In EV portfolios, settlement is where risk crystallizes. Value accuracy becomes visible to the customer, residual value becomes factual, and remarketing outcomes determine the final margin.

Lenders that digitize inspection logic early and connect it directly to payoff, pricing, and remarketing workflows will reduce dispute cycles, shorten turnaround time, and stabilize recovery values.

4. Prepare for Higher Oversight, Exception Scrutiny, and Audit Defensibility

With EV lending, regulators evaluate whether underwriting and settlement decisions are applied consistently, not on a case-by-case basis. EV loans introduce more value judgment at origination and maturity, which increases the importance of system-logged decisions.

What regulators look for

Regulatory teams expect lenders to demonstrate:

- Decision rules executed uniformly

- Pricing variances logged as structured exceptions

- Fee treatment tied to verifiable condition inputs

- Adverse actions showing documented reason codes

- Consumer treatment aligned with value logic, not opinion

This is particularly relevant for EV portfolios, where deviations from standard guidance (e.g., residual adjustments for battery health) must be documented in a defensible manner.

Why oversight intensifies for EV portfolios

EV loans introduce more variables that can materially change outcomes:

- Value shifts tied to battery status

- Fee differences tied to charger equipment

- Warranty milestones affecting resale estimates

- Uneven value drops tied to technology changes

Without traceability, inconsistencies in treatment become visible in examinations.

What lenders must prepare

Systems must support:

- Structured exception justification logging

- Automated disclosure timing and retention

- Rules-driven fee and valuation treatment

- Audit-ready documentation trails for maturity events

This is important because payoff and settlement are highly visible to consumers, and exam teams are increasingly reviewing final-settlement fairness.

5. Prepare for More Complex Payoff, Settlement, and Customer-Experience Expectations

When borrowers near payoff, renewal, or return, their perception of what the car is worth becomes highly visible and measurable through outlets like the Kelley Blue Book.

Unlike standard vehicle portfolios, EV borrowers closely monitor:

- Battery health outlook

- Actual resale range versus original rating

- Market value declines as newer models launch

- Remaining high-cost repair exposure

This means payoff accuracy matters more to customer sentiment and dispute risk.

Why settlement becomes more complex

EV payoff requires factoring:

- Whether charger equipment is included or missing

- Whether software eligibility remains intact

- Whether battery-replacement exposure exists

- Regional resale appetite during the settlement window

A payoff amount that ignores these inputs looks inaccurate to customers, even when contractually correct.

This drives disputes, escalations, slower acceptance of payoff quotes, and declining conversion outcomes.

What lenders must prepare now

Systems should be capable of:

- Recalculating payoff dynamically, not fixed at origination logic

- Presenting value reasoning transparently

- Linking inspection and settlement workflows

- Documenting settlement outcomes auditably

This ensures faster buyout turn-time, fewer disputes, clearer reasoning for pricing differences, and smoother end-of-term customer transitions.

The Business Case for Modern Electric Vehicle Lending Management and Services

Modern electric vehicle lending management and services allow lenders to scale responsibly while reducing loss exposure at payoff, refinancing, and liquidation.

The value upside of doing this well is measurable:

- Higher customer conversion at renewal or payoff when value reasoning is transparent

- Tighter margin preservation because pricing, extensions, and valuations align with actual market movement

- Reduced operating cost through automation of inspections, condition assessments, and settlement routing

- Better auto loan compliance posture because of documented decision trails rather than discretionary exceptions

When lenders rely on static valuation tables, generic condition scoring, or delayed pricing updates, risk compounds late in the loan lifecycle, where it carries the highest cost-to-serve. Modern electric vehicle lending management and services address this, providing lenders with real-time triggers, defendable decision-making rationale, and scalable settlement workflows.

How Lenders Can Scale EV Portfolios Responsibly

Lenders should look for electric vehicle lending management and services designed to handle EV-specific risk and value variability, including:

- Dynamic valuation and pricing alignment

- EV-specific inspection and settlement workflows

- Automated exception logging and decision justification

- Audit-ready compliance documentation

- Configurable rules that evolve with real portfolio outcomes

Book a demo to explore how lenders streamline complex origination and servicing workflows with defi’s configurable technology.

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. For more information on electric vehicle lending management and services, Contact our team today and learn how our cloud-based loan origination products can transform your business.