Loan management has advanced significantly in the last five years. It used to involve juggling spreadsheets, printing statements, mailing notices, and logging borrower interactions by hand. Today, automation, artificial intelligence (AI), and real-time processing power smarter systems that handle everything from payment tracking to risk monitoring with less hassle.

In many ways, the transformation is just getting started. In 2025, emerging technologies and deeper data integrations are pushing loan management trends for banks into a faster, smarter, more responsive phase. This article explores the key forces driving that shift.

Loan Management Trends for Banks, 2025

|

Trend |

Focus Area |

What it Means for Banks & Credit Unions |

|---|---|---|

|

AI & Automation in Loan Servicing |

Faster, smarter loan servicing |

Reduction in delinquencies and costs while improving the borrower experience |

|

Open Finance & Real-Time Data Access |

Live financial insights |

Dynamic risk scoring, income verification, and personalized borrower outreach |

|

Compliance Automation & Fair Lending |

Proactive, tech-enabled compliance |

Reduction in manual work, consistent servicing |

|

Cloud-Based Loan Management Platforms |

Scalable infrastructure |

Replacement of legacy tools, faster servicing, improved security, and real-time updates |

|

Real-Time Loan Performance Analytics |

Portfolio performance tracking |

Real-time and predictive monitoring of loan health and risk assessment |

|

Digital Borrower Experience & Self-Service |

Digital borrower engagement |

Borrower empowerment, reduction in demand on internal servicing teams |

Loan Management Trends to Watch For

AI and Automation Streamline Loan Servicing

Banks are increasingly optimizing AI to cut costs, optimize decisions, reduce friction, and deliver personalized borrower experiences at scale.

Fifth Third Bank is leveraging more than 100 AI-machine learning models to personalize product and service offerings by analyzing customer data. Lincoln Savings Bank, a community bank based in Reinbeck, Iowa, partnered with Kobalt Labs to integrate AI into its compliance operations. The bank’s risk and compliance team reported that the AI tool accurately identified compliance gaps and reduced document review time from multiple days to just 15 minutes, all while improving accuracy. Meanwhile, Live Oak Bank’s fintech division uses predictive credit models and automation to fast-track SBA loan approvals through its new “Live Oak Express” program.

AI is making a measurable impact across multiple stages of loan management:

- Delinquency prediction. Predictive analytics can now flag borrowers at risk of falling behind, sometimes before they even miss a payment. By analyzing income trends, spending behavior, and broader economic signals, loan teams can intervene earlier with payment options or support, reducing defaults before they happen. In fact, organizations implementing AI in collections have reported an average 25% reduction in day sales outstanding (DSO) and up to 30% improvement in collection efficiency.

- Dynamic risk monitoring. Instead of relying on static risk scores, AI continuously updates borrower profiles in the background. This gives servicing teams a live view into portfolio health, helping them prioritize accounts that need attention and streamline servicing for lower-risk borrowers. AI-powered credit risk management systems have achieved up to 96% accuracy in predicting credit risk, significantly surpassing traditional methods.

- Smarter collections. Businesses using AI in credit and collections have seen recovery rates improve by as much as 25%. AI tools can identify not just who is behind on payments, but how and when to reach them most effectively. By personalizing variables like timing, messaging, and delivery channels, lenders are recovering more while minimizing the friction borrowers typically face in traditional collections, like poorly timed calls, impersonal outreach, or confusing next steps.

- Personalized servicing at scale. AI enables tailored outreach across entire loan portfolios, whether it’s sending proactive refinancing offers or nudging borrowers with personalized payment reminders. Studies show that personalized outreach can lead to a 20–30% increase in loan application response rates.

- Operational efficiency. Many institutions are automating behind-the-scenes tasks like interest recalculations, document updates, or escrow disbursements, freeing up employees to focus on more complex borrower needs and relationship-building.

Looking Ahead at AI and Automation

As AI evolves, loan servicing will shift from static process management to real-time, behavior-responsive orchestration. Predictive analytics will power not only delinquency alerts but also proactive refinancing, retention, and repayment strategies.

Paired with embedded tools and generative AI assistants, banks will be able to deliver personalized borrower experiences at scale, without scaling teams.

Open Finance and Real-Time Data Access Transform Servicing

As borrowers demand faster decisions and greater transparency, banks are turning to open finance to deliver. Open finance refers to the secure, consumer-permissioned sharing of real-time financial data—not just from banks, but also from payroll systems, accounting platforms, and other financial tools—via standardized APIs.

This comprehensive, real-time access to a borrower’s financial activity through trusted third-party platforms allows institutions to:

- Dynamically verify income for payment modification requests

- Monitor credit health and adjust risk scores in real time

- Receive alerts for repayment changes, early delinquency signs, or fraud triggers

- Automatically assess eligibility for refinancing, deferral, or restructuring options

For example, a borrower showing signs of inconsistent income via linked payroll data can be flagged for proactive outreach before they miss a payment. Meanwhile, borrowers whose credit health improves could automatically receive personalized refinancing offers, which reduces churn and improves satisfaction.

And adoption is scaling fast. As of April 2025, the Financial Data Exchange (FDX) reported 114 million consumer accounts connected through FDX-compliant APIs, a 50% increase over the prior year.

Meanwhile, according to a survey conducted by Plaid of over 200 bank executives, 61% of respondents say open banking—a core component of the broader open finance movement—is a high priority for their organization, and 57% view it as a competitive advantage rather than just a compliance requirement.

Looking Ahead at Data Access

As regulations push for greater transparency and consumers expect faster, more personalized service, static, one-time data checks won’t be enough. Banks will need ongoing, borrower-approved access to real-time financial data. This shift enables institutions to meet compliance requirements, respond more quickly to borrower needs, and manage risk with greater precision.

Compliance Automation and Fair Lending Monitoring Take Center Stage

With federal regulators tightening oversight and several states introducing Consumer Financial Protection Bureau (CFPB)-style enforcement, loan servicers are facing heightened scrutiny across every stage of the borrower lifecycle. According to Wolters Kluwer’s Regulatory & Risk Management Indicator survey, 61% of financial institutions say they’re concerned about keeping pace with fair lending regulations.

In response, many institutions are turning to tech-enabled compliance solutions to reduce manual oversight, improve audit readiness, and ensure equitable servicing. Even generative AI is beginning to play a role. Frost Bank, based in Texas, employs AI for fraud detection and customer service assistance, utilizing technology to auto-summarize conversations and maintain high-quality human interactions.

Modern loan management platforms now include built-in capabilities for:

- Real-time compliance checks for repayment terms, fee disclosures, and adverse action notices

- Automated documentation and audit trails for all borrower interactions

- AI-driven fair servicing analysis to detect potential bias in collections or hardship relief decisions

- Regulatory reporting dashboards that display relevant servicing data on demand

These tools help institutions stay aligned with federal regulations like the Equal Credit Opportunity Act (ECOA) and Fair Debt Collection Practices Act (FDCPA), as well as an expanding patchwork of state-level rules.

Looking Ahead at Compliance Monitoring

In the coming years, expect loan servicing platforms to make compliance even faster, more efficient, and—crucially—fairer and more proactive by design. This is already happening through embedded AI rule engines, automated disclosures and audit trails, and real-time analytics that flag risks and ensure consistent borrower treatment.

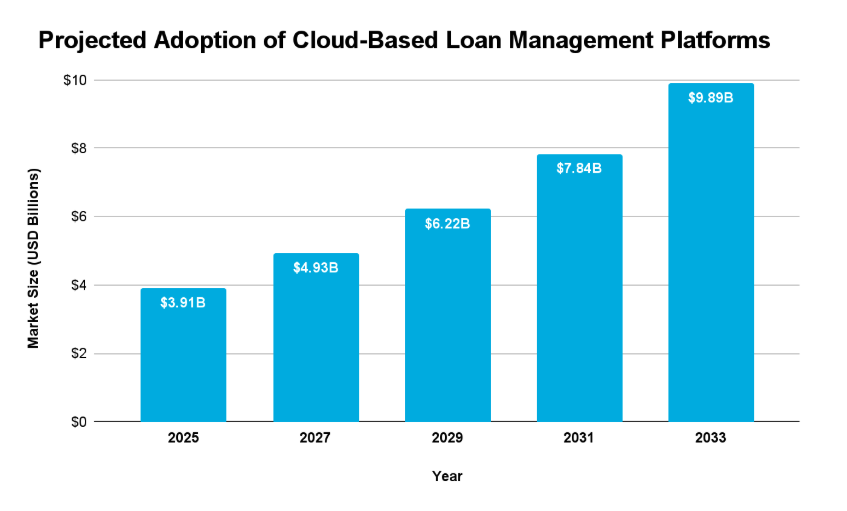

Cloud-Based Loan Management Platforms Replace Legacy Systems

The global loan servicing software market is projected to grow from $3.91 billion in 2025 to $9.89 billion by 2033, at a 12.3% compound annual growth rate (CAGR). This is because many banks are phasing out outdated, on-premises systems in favor of cloud-based loan management platforms.

These platforms empower servicing teams to:

- Access borrower data and dashboards securely from anywhere

- Scale operations without infrastructure constraints

- Use APIs to integrate with fraud detection tools, payment processors, CRM systems, and other core services

- Deploy updates and new features instantly

- Ensure business continuity and data security through built-in redundancy and encryption

Cloud-native loan management platforms are especially valuable for institutions managing multiple loan products—such as auto, personal, and commercial—within a single ecosystem. Instead of siloed databases and batch-based workflows, cloud solutions provide unified views, faster servicing, and smarter portfolio oversight.

Looking Ahead at Cloud-Based Loan Management

As lending becomes more digitally connected and geographically decentralized, cloud-native platforms will continue to gain traction. Expect increased investment in platform consolidation, built-in compliance automation, and AI-powered tools that help institutions manage risk, adapt faster, and deliver consistent borrower experiences.

Loan Performance Analytics and Portfolio Monitoring Go Real-Time

Loan servicing today requires continuous monitoring of portfolio health and responding in real time. Thus, banks are investing in advanced analytics platforms that track repayment trends, assess credit risk, and surface early warning signs of default.

With the help of AI and machine learning, servicing teams now use real-time dashboards and predictive models to make faster, smarter decisions. These tools allow institutions to:

- Monitor repayment behavior and credit use across borrower segments

- Flag high-risk accounts based on income volatility, transaction patterns, or external risk indicators

- Prioritize outreach, restructuring, or payment modifications to reduce losses

- Identify early payoff risk or borrower churn to improve long-term portfolio performance

- Track key metrics like non-performing loans (NPLs), charge-off rates, and customer lifetime value

The impact is tangible. JP Morgan Chase reduced defaults by up to 20% and cut servicing costs by 15% after implementing AI-driven credit risk assessment tools. For regional and community banks with leaner teams, real-time analytics platforms offer a way to scale insights and improve outcomes without increasing headcount.

Looking Ahead at Loan Performance Analytics

As data becomes more accessible and analytics platforms more intuitive, performance monitoring is shifting from periodic reports to continuous intelligence. Expect deeper integration with servicing workflows, automated action triggers, and AI-generated insights that allow loan managers to address issues proactively and seize emerging opportunities.

Self-Service Portals and the Digital Borrower Experience Take Priority

In 2025, borrowers are demanding seamless digital experiences in all platforms they use, including financial apps. To meet those rising standards, banks are modernizing their self-service portals to deliver convenience, autonomy, and speed.

Today’s borrowers expect to:

- View real-time balances, statements, and payment history

- Schedule or adjust payments without contacting support

- Submit loan modification or deferral requests online

- Get immediate answers via chatbots or virtual assistants

- Upload documents and manage account information from any device

According to a Zendesk survey, 67% of respondents said they prefer self-service over speaking to a representative. For institutions managing diverse loan products, these portals offer a scalable way to provide consistent service while freeing up employees to handle higher-value borrower needs.

Looking Ahead at the Digital Borrower Experience

As digital expectations climb, self-service portals are set to become full-scale digital loan hubs, with features like AI-driven insights, interactive payment simulations, personalized alerts, and smarter workflows that guide borrowers throughout the loan lifecycle.

Stay Ahead in a Shifting Landscape with defi SOLUTIONS

In 2025, banks are rethinking every aspect of the servicing experience, including compliance, risk monitoring, borrower engagement, and operational agility.

The loan management trends for banks in this article all circle around how technology is reimagining traditional loan servicing. If you’re a bank ready to modernize your loan servicing strategy, now’s the time. The right tools are already here, and those who act today will be better equipped to grow, adapt, and lead in the years ahead.

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny.

With defi loan origination software, lenders can increase revenue and productivity through automation, configuration, and integrations, and incorporate data and services that meet unique needs. For more information on loan management trends for banks, contact our team today and learn how our cloud-based loan origination products can transform your business.