The vehicle leasing market is shifting into high gear. Globally, it’s projected to grow from $596.4 billion in 2025 to over $1.13 trillion by 2033, representing a compound annual growth rate (CAGR) of 8.3%. This growth is fueled in part by consumers who prioritize flexibility over ownership, especially in urban or high-density areas where parking and maintenance pose real challenges.

To keep pace with this shift, lenders need infrastructure designed for leasing at scale. A vehicle lease management system is now foundational to running a compliant, profitable, and adaptable lease operation. Unlike retrofitted loan platforms, a purpose-built system supports the full lease lifecycle, automating everything from origination to end-of-term outcomes.

This article covers what vehicle lease management software does, why you need it, and how it benefits lenders.

The Need for Vehicle Lease Management Software

Many lenders already know that leasing comes with a unique set of challenges, like tracking residual values, managing buyouts, renewals, and end-of-term transitions. What they may not realize is how much smoother these processes can be with the right system in place.

Unlike traditional loan origination tools, purpose-built lease management platforms are designed to handle every stage of the lease lifecycle. They centralize all the moving parts—residual value tracking, real-time adjustments, mid-term changes, asset returns, and more—into one flexible environment. Many now incorporate AI-driven insights and workflow automation to help teams act faster and with greater precision.

With these tools, lenders can reduce manual work, close compliance gaps, and deliver a seamless experience to lessees. Instead of stitching together spreadsheets and workarounds, you gain a unified system built for the way leasing actually works.

If your current system wasn’t designed for leasing, now’s the time to consider one that is.

What Vehicle Lease Management Software Does

Key Functions of Vehicle Lease Management Software |

|||

|---|---|---|---|

|

Lease Origination |

Lease Servicing |

Lease-End |

Lifecycle Tools & Flexibility |

|

Capture lease terms: (mileage, residual value, payments) |

Track payments, auto-debits, and NSF events |

Automate final billing for excess mileage, damages, and end-of-term fees |

Configure rules, workflows—no-code required |

|

Integrate with credit bureaus, valuation tools, and CRMs |

Monitor insurance and send lapse or renewal alert |

Manage inspections with photo-documented wear and tear |

Access real-time analytics on lease performance and risk |

|

Automate taxes, fees, incentives, and pricing |

Handle mid-term changes: extensions, early terminations, reschedules |

Guide customers through returns, renewals, buyouts, or upgrades |

Integrate with external systems (CRM, accounting, inspections) |

|

Support applications across multiple lease channels |

Run real-time checks: credit, fraud, and compliance |

Trigger end-of-term workflows with automated alerts |

Support all lease models and scale across portfolio types |

|

Generate digital lease documents with eSignatures |

Centralize billing, communication, and document access |

Coordinate asset return, resale preparation, or reassignment |

Manage residual value and asset disposition planning |

Vehicle lease management software encompasses a comprehensive suite of features designed to support every phase of the leasing lifecycle. It enables leasing companies to structure, automate, and scale operations, from application intake to end-of-term resolution.

Lease origination

In the origination stage, lease management software collects all the key details needed to structure a compliant and profitable lease. This includes mileage limits, lease duration, projected residual value, and payment terms. It connects with credit bureaus and vehicle valuation services to speed up approvals and ensure the deal makes financial sense. The system also handles digital paperwork, which makes it easy to generate documents, collect eSignatures, and move leases forward without delays or manual processing.

Lease servicing

After the lease begins, the software takes over day-to-day servicing. It tracks payments, identifies missed due dates or late fees, and monitors mileage to ensure lessees stay within agreed limits. Many platforms also keep tabs on maintenance schedules and insurance status, sending automated reminders when action is needed. Real-time alerts help both lenders and borrowers stay ahead of key events—like upcoming renewals, early terminations, or lease-end planning—so nothing falls through the cracks.

Lease-end

As leases reach maturity, the platform supports a smooth and structured closeout process. Whether the customer is returning the vehicle, renewing the lease, buying it out, or upgrading, the system guides them through each relevant step. It also manages vehicle inspections, captures wear-and-tear assessments, and calculates any final charges or adjustments. Built-in residual value tracking and asset disposition tools ensure vehicles are processed efficiently, which is especially important for lenders managing high volumes or expanding portfolios.

Operational lifecycle tools

Throughout the lease lifecycle, advanced platforms offer tools that keep operations agile and scalable. For instance, no-code configuration lets your team update workflows, rules, and calculations without needing IT support. Real-time analytics provide visibility into lease performance, risk indicators, and portfolio trends.

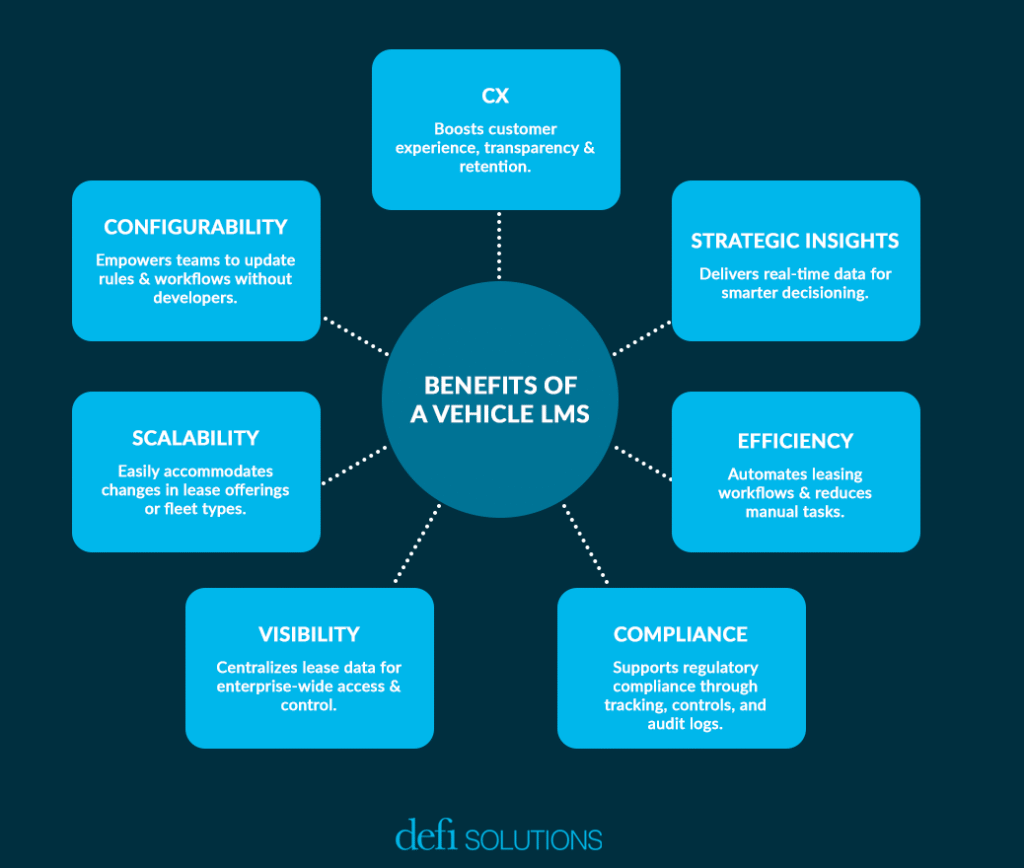

How Vehicle Lease Management Software Benefits Lenders

The auto-leasing sector is operationally complex, margin-sensitive, and deeply intertwined with compliance. Legacy systems and manual workarounds simply aren’t capable of meeting today’s volume, velocity, or risk profile. That’s why modern lenders are adopting purpose-built vehicle lease management software.

Streamline operations

The leasing sector is operationally complex, margin-sensitive, and deeply intertwined with compliance. Legacy systems and manual workarounds simply can’t support today’s volume, velocity, or risk profile. That’s why modern lenders are adopting purpose-built vehicle lease management software.

Gain real-time visibility

With all lease data, like contract status, inspection results, document history, asset location, and customer communications, housed in a centralized platform, teams get instant access to accurate information without digging through siloed systems or spreadsheets. This enables faster decisioning, better collaboration, and increases oversight across the board.

Scale with confidence

As your lease portfolio grows with more vehicles, new asset classes, or expanding markets, the vehicle lease management platform allows you to support that growth. Built-in flexibility supports new workflows, user roles, and product types without requiring major system changes.

Adapt without IT bottlenecks

Most lease management software for vehicles supports no-code configuration, which means business users can easily adjust pricing logic, lease terms, and approval workflows without waiting on development teams.

Stay ahead of compliance risks

Vehicle lease management platforms include built-in safeguards that help ensure regulatory and contractual compliance. They enable teams to monitor variables like lease terms, mileage limits, insurance coverage, and asset condition in real time. Audit trails, role-based access controls, and automated alerts further strengthen accountability and reduce the risk of non-compliance.

Deliver a better customer experience

Vehicle lease management software has tools integrated into the platform that simplify onboarding, while self-service portals and automated notifications keep lessees informed throughout the lease. The transparency around pricing, payment schedules, and end-of-term options leads to fewer support calls and higher retention at lease-end.

Data-driven decisioning

Most vehicle lease management platforms track key metrics like delinquency trends, vehicle utilization, and overall lease performance. With real-time data at your fingertips, you can uncover insights that inform pricing strategies, strengthen risk management, and drive more strategic portfolio planning.

Modernize Your Leasing Operations With defi’s Lease Management Platform

defi’s vehicle lease management solution is built from the ground up to meet the demands of modern leasing, not retrofitted from a lending platform. It supports the full lease lifecycle, from origination through servicing to end-of-term transitions, all while enabling real-time decisioning, flexible workflows, and deep configurability.

Here’s what you can expect from our vehicle lease management software:

- Covers the full lease lifecycle—origination to end-of-term returns, upgrades, and renewals.

- Configures rules and workflows with no-code tools for faster approvals and consistent servicing.

- Automates billing, payments, alerts, and communications across all channels.

- Delivers real-time insights and cloud-based access to support compliance, performance, and CX.

If you are ready to level up your leasing operations, contact us today to see defi’s purpose-built vehicle lease management platform in action.

defi SOLUTIONS is redefining loan origination with software solutions and services that enable lenders to automate, streamline, and deliver on their complete end-to-end lending lifecycle. Borrowers want a quick turnaround on their loan applications, and lenders want quick decisions that satisfy borrowers and hold up under scrutiny. With defi ORIGINATIONS, lenders can increase revenue and productivity through automation, configuration, and integrations, and incorporate data and services that meet unique needs. For more information on vehicle lease management software, contact our team today and learn how our cloud-based loan origination products can transform your business.